In this article, three Motley Fool contributors underscore the potential for significant long-term wealth generation by investing in artificial intelligence (AI) stocks, even with modest initial investments.

Following a thorough analysis, Microsoft (NASDAQ: MSFT), Qualcomm (NASDAQ: QCOM), and Meta Platforms (NASDAQ: META) emerged as top choices for investors looking to capitalize on the AI sector while adhering to a budget under $1,000.

Here’s what you should know about these compelling investment opportunities.

Microsoft’s OpenAI partnership is paying big dividends

Justin Pope emphasizes Microsoft’s strategic partnership with OpenAI, which has evolved into a significant advantage for the tech giant. Initially forged in 2019, the collaboration has seamlessly integrated OpenAI’s technology into Microsoft’s software products while leveraging Microsoft’s Azure cloud platform for OpenAI’s compute needs.

Beyond its flagship ChatGPT model, OpenAI has expanded its offerings to include the recently launched video creation engine Sora and ventures into humanoid robotics through collaborations with Nvidia and Microsoft.

Despite Microsoft’s already formidable position as a $3 trillion company with substantial financial resources and robust cash flow, its partnership with OpenAI underscores its commitment to AI innovation. With Microsoft generating approximately $70 billion in free cash flow annually, the partnership amplifies the company’s potential for future growth and innovation in the AI space.

While Microsoft boasts numerous reasons for long-term investment, including its financial strength and market dominance, the synergies with OpenAI further enhance its prospects. As AI continues to play an increasingly pivotal role in technology and innovation, Microsoft’s collaboration with OpenAI positions it for sustained success and growth.

The overlooked AI communications stock that can connect investors to profits

Will Healy brings attention to Qualcomm as a significant player in the AI chip sector, often overshadowed by Nvidia’s dominant market position. Despite this, Qualcomm’s influence in enabling generative AI extends to various devices, notably smartphones powered by its Snapdragon 8 Gen 3 chip. This latest release supports AI models with up to 10 billion parameters, unlocking capabilities like AI-enhanced images, immersive gaming experiences, and high-quality audio directly from users’ devices.

Beyond smartphones, Qualcomm’s AI expertise spans the Internet of Things and automotive sectors, with plans to develop processors for laptops and tablets, further expanding its reach in AI applications.

Qualcomm’s recent financial performance reflects resilience amid industry challenges, with revenue in the first quarter of fiscal 2024 increasing by 5% year over year, following a 19% decline in fiscal 2023. Notably, the company maintained profitability, with GAAP net income rising by 24% annually to $2.7 billion in fiscal Q1.

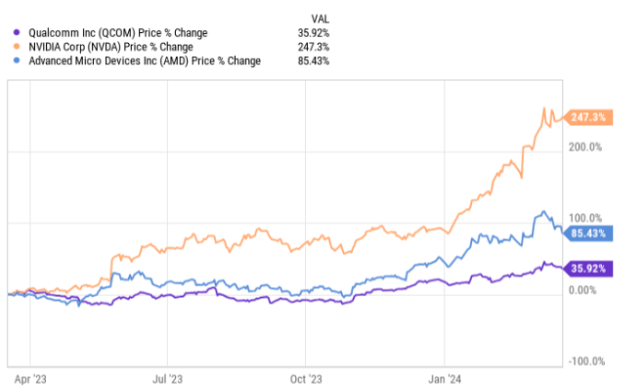

While Qualcomm’s stock has surged by 35% over the past year, its performance trails behind other AI chip stocks like Nvidia and Advanced Micro Devices. Whether this reflects investors’ recognition of Qualcomm’s AI potential or concerns about its recent financial performance remains unclear.

Nonetheless, with a P/E ratio of 24 and a forward P/E ratio of 17, one can argue that Qualcomm is attractively priced, particularly when considering AMD’s forward earnings multiple of 50 or Nvidia’s price-to-sales ratio of 37.

That valuation could give investors a chance to buy into an AI chip stock at an attractive price. Also, at $165 per share, investors with a $1,000 budget have the opportunity to purchase a few shares before more investors notice Qualcomm’s AI capabilities.

Meta combines the best features of a start-up and a cash cow

Jake Lerch sheds light on Meta Platforms as an overlooked AI stock, despite its remarkable 41% year-to-date growth. This disparity is rooted in Meta’s unique blend of characteristics: it functions both as a cash-generating powerhouse and a forward-thinking tech startup.

At its core, Meta boasts a lucrative advertising business that raked in nearly $135 billion in revenue last year, predominantly from platforms like Facebook, Instagram, and WhatsApp. With a remarkable 35% conversion rate of revenue into operating profit, Meta’s asset-light model has enabled it to introduce regular dividend payments, rewarding shareholders.

However, Meta’s ambitions extend far beyond its profitable social media empire. The company is heavily investing in AI research, with plans to utilize Nvidia’s flagship AI chip, the H100, to power its AI models. Meta’s visionary founder, Mark Zuckerberg, has disclosed plans to deploy over 350,000 H100 chips this year alone.

This substantial computing power serves multiple ambitious objectives, including refining its vision of the metaverse and pursuing the development of Artificial General Intelligence.

In essence, Meta presents investors with a compelling proposition: the potential for explosive growth if it achieves its ambitious AI objectives, coupled with a steady stream of cash flow from its established social media business. As such, Meta emerges as a promising AI stock suitable for long-term investment.