- The AUD/JPY gains ground as expectations rise for the RBA to refrain from implementing rate cuts.

- Australia’s 10-year bond yield rises to 4.1%, reaching its highest point in more than a month.

- Reduced geopolitical tensions may undermine the safe-haven appeal of the JPY, potentially contributing to its weakness.

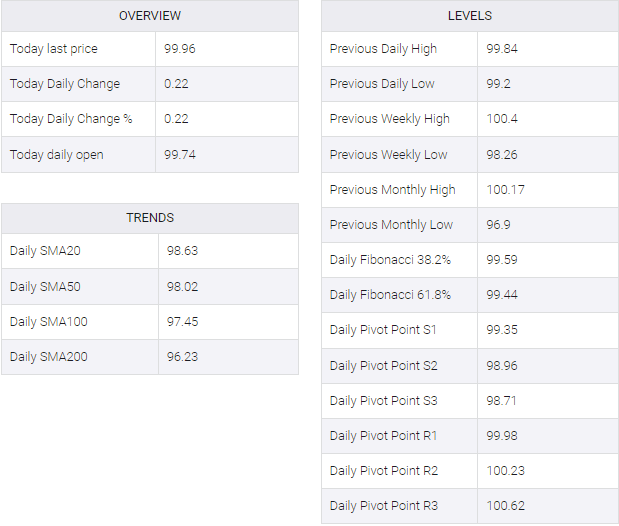

During Monday’s European session, the AUD/JPY continued its upward trajectory, nearing the 99.90 mark. This rise is attributed to the strengthening of the Australian Dollar (AUD), buoyed by gains in the domestic equity market. The ASX 200 Index showed positive momentum at the start of the week, especially driven by a surge in tech stocks.

Furthermore, Australia’s 10-year government bond yield climbed to nearly 4.1%, reaching highs not seen in over a month. This uptick follows a rally in US bond yields, propelled by robust US jobs data. Speculation has emerged that the Federal Reserve might uphold higher interest rates for a prolonged period.

Investor skepticism regarding the necessity for the Reserve Bank of Australia (RBA) to lower interest rates in 2024 is growing. This sentiment is reinforced by upbeat US data, strengthening the belief that borrowing costs in the US will remain elevated.

Last week, unchanged Final Retail Sales and discouraging Trade Balance data from Australia weighed on the Australian Dollar (AUD). Market watchers are closely monitoring copper and oil prices, as further appreciation could potentially bolster the AUD, thereby supporting the AUD/JPY pair.

The Japanese Yen (JPY) faces continued downward pressure as the Bank of Japan (BoJ) maintains a cautious stance on further policy tightening. Additionally, diminished geopolitical tensions in the Middle East could dampen the appeal of the safe-haven JPY. Israel’s decision to withdraw additional troops from Southern Gaza, possibly in response to international pressure, has contributed to a relaxation of tensions.

Earlier on Monday, Bank of Japan (BoJ) Governor Kazuo Ueda expressed his desire to simplify and clarify the central bank’s policy framework, contingent upon economic conditions. Governor Ueda made these remarks reflecting on his year-long tenure.

AUD/JPY