- The hourly Relative Strength Index (RSI) showed signs of recovery after reaching oversold conditions.

- On the daily chart, a bearish sentiment is more apparent, with the 100-day Simple Moving Average (SMA) under threat by the bears.

- The overall bullish trend will be sustained as long as the bulls can maintain support above the 100 and 200-day SMAs.

In Monday’s trading session, the AUD/JPY pair initiated the week with a decline of 0.50%, hovering around the 96.97 level. While bears currently hold sway in the short term, their momentum appears to be waning. However, on a broader scale, the overall outlook remains bullish.

Examining the daily chart of the AUD/JPY pair reveals a pessimistic perspective. The Relative Strength Index (RSI) continues to dwell in negative territory, indicating a potential move towards oversold conditions. Simultaneously, the Moving Average Convergence Divergence (MACD) displays an increase in red bars, signifying a heightened bearish momentum.

AUD/JPY daily chart

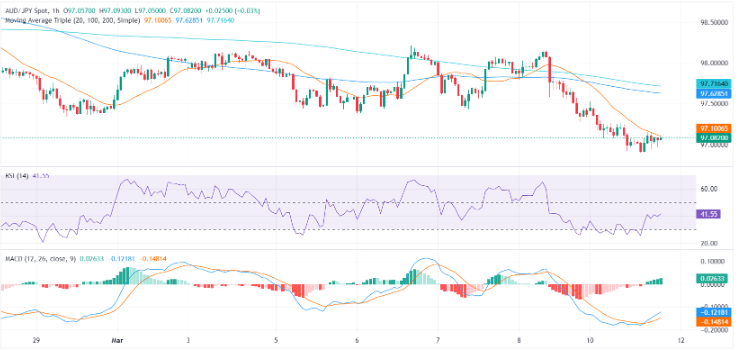

Turning our attention to the hourly chart, the Relative Strength Index (RSI) rebounded from a low of 30, suggesting a potential consolidation in bearish movements. Meanwhile, the hourly Moving Average Convergence Divergence (MACD) reveals ascending green bars, signaling an increase in positive momentum.

AUD/JPY hourly chart

In summary, while bears currently hold sway in the short term, there are indications that the selling momentum is diminishing. This potential weakening of bearish pressure provides an opportunity for buyers to initiate an upward move. Moreover, when considering the broader scale outlook and the pair’s position above its 100 and 200-day Simple Moving Averages (SMAs), the overall control remains bullish, even though the pair is trading below the 20-day average.

AUD/JPY