- The Australian Dollar extends its upward momentum, securing a positive streak for the third consecutive day.

- Meanwhile, the US Nonfarm Payrolls surpass projections with a notable figure of 275,000, yet concerns arise as increasing unemployment and diminished wage growth suggest a potential slowdown in the job market.

- The AUD/USD rally finds support in the declining US 10-year Treasury yields and a weakening Dollar Index, reflecting the ongoing adjustments in global monetary policies.

The Australian Dollar has achieved a three-day consecutive advance, making early gains in the North American session with a 0.35% increase, trading at 0.6654.

Aussie Dollar’s strengthens as US Dollar extends its weekly losses

Recent data from the US Department of Labor revealed that February’s Nonfarm Payrolls exceeded expectations, reaching 275K compared to the estimated 200K. This figure was higher than January’s revised reading of 229K, down from the initially reported 353K. However, there are indications of a cooling job market, with the Unemployment Rate rising from 3.7% to 3.9%, and both monthly and annual Average Hourly Earnings showing a decline.

Amidst these developments, the AUD/USD continued its upward momentum, reaching a daily high of 0.6664, while US Treasury bond yields experienced a decline. The US 10-year benchmark note rate dropped to 4.044%, marking its lowest level since February 2.

Simultaneously, the US Dollar Index (DXY) is undergoing a 0.25% decline, standing at 102.52 and posing a threat to reach an eight-week low.

New York Fed Williams: Neutral interest rates “still quite low”

In a recent statement, New York Fed President John Williams remarked that the restrictive monetary stance has had a dampening effect on demand. He emphasized the Federal Reserve’s commitment to achieving price stability and clarified that political considerations do not influence their deliberations. Williams also expressed his positive view on the economy, describing it as remarkable for the year 2023.

Additionally, Australian data released this week indicated a surplus in the Trade Balance. However, the economic growth in the fourth quarter of 2023 came in at 0.2% QoQ, falling short of the 0.3% estimates. On an annual basis, the economy expanded by 1.5% YoY, surpassing expectations but not reaching the previous reading of 2.1%.

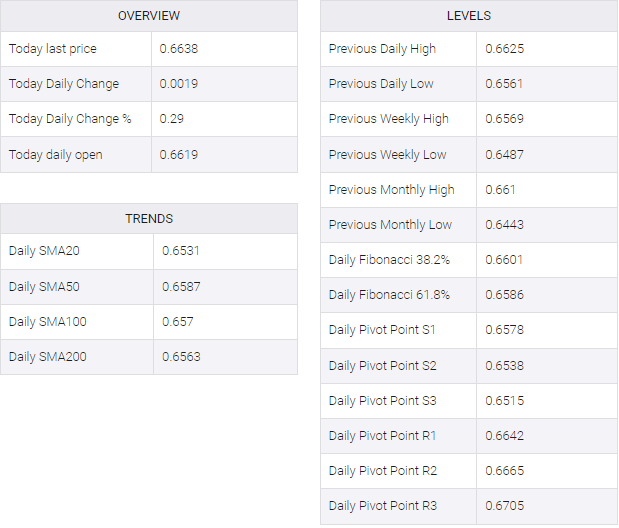

AUD/USD Price Analysis: Technical outlook

With the AUD/USD currently positioned above the 0.6600 threshold, it signals the potential for continued upward movement, a sentiment supported by the Relative Strength Index (RSI) residing in bullish territory. Should buyers propel the rally towards 0.6700, it may pave the way for testing the January 5 high at 0.6747, with further upside potential towards the 0.6800 level. Conversely, a retreat below the January 5 low of 0.6640 could intensify the likelihood of testing the 0.6600 mark.

AUD/USD