- Ahead of the Federal Reserve’s monetary policy decision, the AUD/USD pair is facing downward pressure while managing to hold above the psychological support level of 0.6500 during Wednesday’s late European session.

- The Australian Dollar weakened following the Reserve Bank of Australia (RBA) Governor Michele Bullock’s neutral stance on the Official Cash Rate (OCR), which remains unchanged at 4.35%.

Market sentiment appears cautious as evidenced by a slight decline in S&P 500 futures during the late London session. This caution is likely due to investors awaiting guidance from the Fed’s monetary policy announcement. The US Dollar Index (DXY) has been gaining ground for the fifth consecutive trading session, reaching 104.10. Meanwhile, 10-year US Treasury yields have moderated slightly to 4.28%, but remain robust ahead of the Fed meeting.

According to the CME Fedwatch tool, interest rates are expected to remain unchanged within the range of 5.25%-5.50%, marking the fifth consecutive meeting without a change. The Fed is unlikely to signal any imminent rate cuts, especially with inflation persistently above the 2% target. February’s consumer price inflation exceeded expectations, primarily driven by higher food and gasoline prices. The possibility of rate cuts will only be entertained if inflation shows signs of declining to 2%.

Investors will closely monitor the Fed’s dot plot and economic projections, both of which are updated quarterly. The dot plot provides insights into policymakers’ interest rate projections for various timeframes. If the Fed projects fewer rate cuts compared to the previous update in December, it could bolster demand for safe-haven assets.

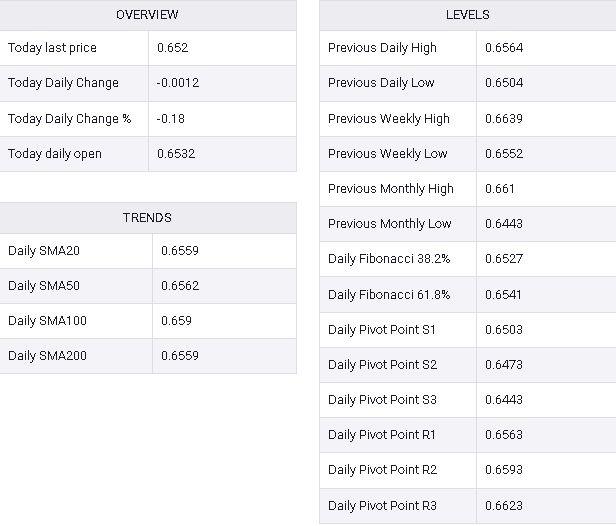

AUD/USD