- AUD/USD cycles just north of 0.6550.

- Little Aussie data to chew on leaves AUD/USD in the lurch.

- Next week: double-header showings from RBA and Fed.

The AUD/USD is hovering just above 0.6550 as investors brace for a significant week ahead, marked by pivotal announcements from both the Reserve Bank of Australia (RBA) and the US Federal Reserve (Fed). Anticipation surrounds whether these central banks will maintain interest rates unchanged or hint at potential future rate cuts. Recent shifts in market sentiment have seen expectations of a June rate cut from the Fed decrease to 60%, down from 70% at the beginning of the week, as indicated by the CME’s FedWatch Tool.

Additionally, Australia’s upcoming labor and employment data, scheduled for release on Thursday, will draw attention. Market forecasts project an increase of 30K new jobs in February, with the Unemployment Rate expected to decline to 4.0% from 4.1%. Preliminary figures for the Judo Bank Australian Purchasing Managers Index (PMI) for February are also on the agenda for Thursday.

The focus will intensify on Wednesday with the Fed’s rate statement, where the central bank is anticipated to update the Fed Dot Plot summary, reflecting interest rate expectations. The short-term end of the Dot Plot curve is expected to rise to 5.5% from the current 4.6%. Despite expectations in the market for at least three 25 basis point rate cuts from the Fed in 2024, recent developments have showcased a discrepancy between investor sentiment and the Fed’s rate outlook. While the Fed has projected three rate cuts throughout 2024, market expectations have priced in a significantly higher number, reaching up to six or seven rate cuts totaling nearly 200 basis points for the year.

Given the sustained strength of the US economy and persistent inflationary pressures, market participants have been compelled to revise down their expectations for rate cuts, with some cautiously eyeing a potential rate cut in June.

AUD/USD technical outlook

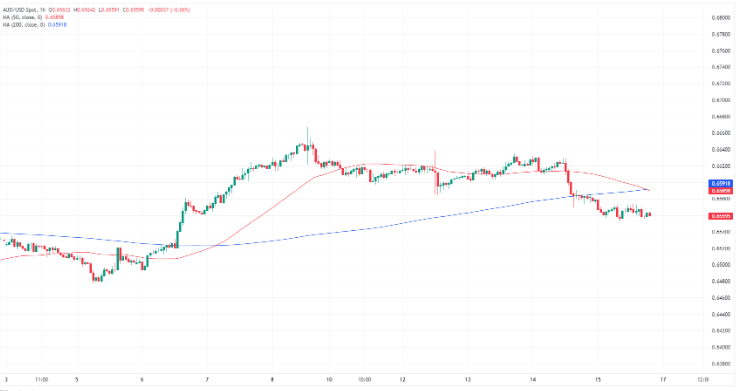

Throughout the trading week, AUD/USD predominantly trended lower, descending towards the 200-hour Simple Moving Average (SMA) around 0.6580 by Thursday. The emergence of a bearish crossover between the 50-hour and 200-hour SMAs, occurring near 0.6585, further accentuated the intraday bearish sentiment. Despite a brief attempt to push higher towards 0.6640 earlier in the week, the pair struggled to sustain bullish momentum.

On Friday, AUD/USD experienced a slight decline of one-third of a percent, bringing it close to the 200-day SMA against the US Dollar around 0.6560. With momentum leaning towards bearish territory, the pair failed to gather bullish strength following a rebound from the recent swing low around the 0.6450 level.

AUD/USD hourly chart

AUD/USD daily chart

AUD/USD