According to the US Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) in the US surged to 3.5% year-on-year in March, up from 3.2% in February. This exceeded market forecasts of 3.4%. Meanwhile, the annual core CPI, which excludes volatile food and energy prices, remained steady at 3.8% compared to February. On a monthly basis, both the CPI and core CPI increased by 0.4%, surpassing analysts’ expectations of 0.3%.

In its press release, the BLS pointed out that in March, the index for shelter experienced an uptick, along with the index for gasoline. Together, these two indexes accounted for more than half of the monthly rise in the index for all items. The energy index saw a 1.1% increase over the month. Additionally, the food index in March showed a slight 0.1% increase. While the food at home index remained unchanged, the food away from home index rose by 0.3% during the same period.

Market reaction to US Consumer Price Index data

Following the announcement, the US Dollar exhibited strength against its main counterparts. As of the latest update, the US Dollar Index surged by 0.55% to reach 104.70.

US Dollar price today

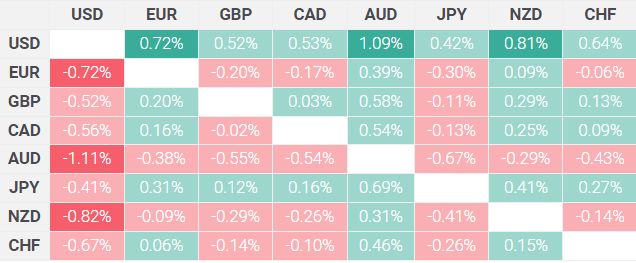

Today’s table displays the percentage change of the US Dollar (USD) against various major currencies. Notably, the US Dollar demonstrated its strength primarily against the Australian Dollar.

The following excerpt was released as a preview of the upcoming US Consumer Price Index (CPI) data at 03:00 GMT.

The US Consumer Price Index is projected to increase by 3.4% year-over-year in March, up from the 3.2% rise recorded in February. Meanwhile, annual core CPI inflation is anticipated to slightly decrease to 3.7% year-over-year in March. This inflation report has the potential to influence market expectations regarding the probability of a rate cut in June.

- The Bureau of Labor Statistics (BLS) is scheduled to release the high-impact US Consumer Price Index (CPI) inflation data for March on Wednesday at 12:30 GMT.

- This data has the potential to reshape market expectations regarding the timing of the Federal Reserve (Fed) policy adjustment, particularly as investors harbor growing uncertainties about the likelihood of an interest-rate cut in June.

- Any unexpected developments in inflation are poised to intensify volatility surrounding the US Dollar (USD).

What to expect in the next CPI data report?

In March, inflation in the United States (US) is anticipated to accelerate, with a projected annual rate of 3.4%, surpassing February’s 3.2% uptick. Meanwhile, the core CPI inflation rate, excluding volatile food and energy prices, is expected to ease slightly to 3.7% from the previous 3.8%.

Both the monthly CPI and core CPI are forecasted to rise by 0.3% in March.

Federal Reserve (Fed) Chairman Jerome Powell, speaking at an event hosted by the Stanford Graduate School of Business, indicated that the policy rate may have reached its peak in this cycle. However, he emphasized that there’s no rush to lower rates. Powell stated, “It’s premature to determine whether recent inflation indicators signify more than a temporary fluctuation,” noting that the Fed will allow incoming data to guide policy decisions.

Previewing the March inflation report, analysts from TD Securities anticipate a slowdown in core inflation to a “moderate” 0.3% monthly pace following an uptick to around 0.4% in January/February. They expect used vehicle prices to decline, possibly resulting in deflation, while inflation in Owners’ Equivalent Rent (OER) might see an increase. It’s worth noting that their unrounded core CPI forecast of 0.26% monthly suggests a higher risk for a dovish surprise compared to a rounded 0.2% increase.

How could the US Consumer Price Index report affect EUR/USD?

Following a 0.2% increase in December, the Consumer Price Index (CPI) saw rises of 0.3% and 0.4% in January and February, respectively, while the core CPI increased by 0.4% in both months. These figures reignited concerns about a slowdown in disinflationary progress, leading market participants to refrain from projecting a rate cut until June.

Meanwhile, the Bureau of Labor Statistics (BLS) reported a robust increase of 303,000 in Nonfarm Payrolls for March, following February’s 270,000 growth and surpassing market expectations of 200,000. This highlighted tight conditions in the labor market, prompting the CME FedWatch Tool’s probability of a 25 basis points rate reduction in June to decrease towards 50% from above 60% prior to the jobs report release.

Market positioning indicates that the US Dollar faces a dual risk leading up to the inflation data release. Should the monthly core CPI climb by 0.4% or more, it could instill confidence in investors that the Fed will maintain rates in June, particularly after the strong labor market data for March. In such a scenario, the USD is likely to strengthen against its major counterparts in immediate response. Conversely, a reading of 0.2% or lower could rekindle optimism about continued disinflation, leading investors to lean towards a rate cut in June and prompting a USD sell-off.

Eren Sengezer, European Session Lead Analyst at FXStreet, provides a brief technical outlook for EUR/USD, stating: “The Relative Strength Index (RSI) indicator on the daily chart remains flat near 50 ahead of the US inflation data, underscoring EUR/USD’s short-term indecision. Additionally, the pair needs to break out of the 1.0830-1.0870 range, where the 200-day and the 100-day Simple Moving Averages (SMA) are located, to determine its next direction.”

Sengezer further explains, “If EUR/USD surpasses 1.0870 (100-day SMA) and establishes this level as support, it could target 1.0960 (Fibonacci 23.6% retracement level of the October-December uptrend) next. Conversely, if 1.0830 (200-day SMA) support falters, technical sellers may take action, potentially leading to an extended decline towards 1.0700 (end-point of the downtrend).”