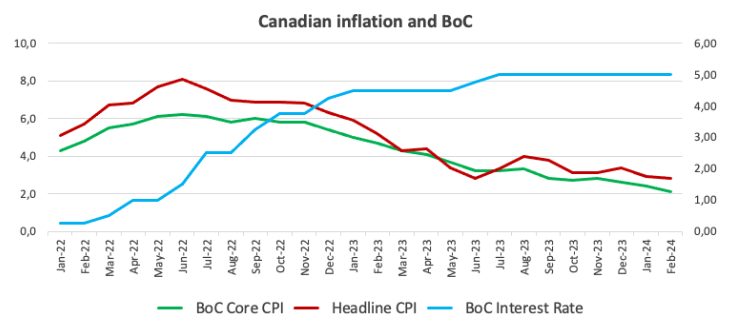

According to the latest report from Statistics Canada released on Tuesday, Canada’s inflation rate, as measured by the Consumer Price Index (CPI), moderated to 2.8% annually in February, down from January’s 2.9%. This figure fell below market expectations of 3.1%. On a monthly basis, the CPI experienced a 0.3% increase, compared to no change in the previous month.

During the same period, the annual Core CPI, which excludes volatile food and energy prices, grew by 2.1%, a decrease from January’s 2.4%.

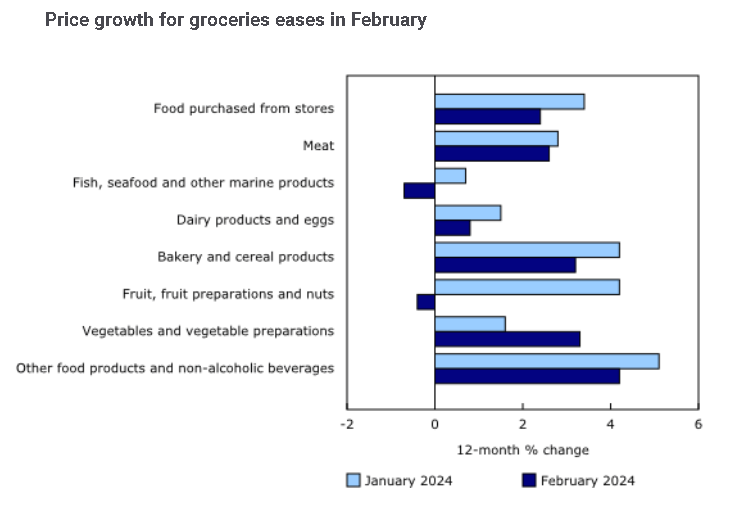

In the press release, it was noted that prices for food purchased from stores continued to show moderation on a year-over-year basis in February (+2.4%) compared to January (+3.4%). This slowdown in price growth was widespread, with decreases observed in prices for fresh fruit (-2.6%), processed meat (-0.6%), and fish (-1.3%). Additionally, other food categories such as other food preparations (+1.4%), preserved fruit and fruit preparations (+4.0%), cereal products (+1.7%), and dairy products (+0.6%) experienced decelerated growth in February.

February marked the initial month since October 2021 where grocery prices escalated at a pace slower than headline inflation. This deceleration in price growth can be partly attributed to a base-year effect. In February 2023, food purchased from stores surged by 0.7% month over month, a consequence of supply constraints stemming from unfavorable weather conditions in growing regions and elevated input costs.

Market reaction to Canada CPI data

Following the subdued inflation figures for February, the Canadian Dollar faced exacerbated downward pressure, lifting USD/CAD north of 1.3600 the figure, or multi-day highs.

- The Canadian Consumer Price Index is expected to have risen by 3.1% YoY in February.

- The BoC shows no rush to lower its interest rate.

- The Canadian Dollar maintains its multi-day lows against the US Dollar around 1.3540.

Canada is set to unveil significant inflation-related data on Tuesday, with Statistics Canada releasing the Consumer Price Index (CPI) for February. Expectations suggest a year-on-year increase of 3.1% in the headline figure, slightly higher than January’s 2.9%. Projections for the month anticipate a 0.6% rise compared to the previous month’s flat reading.

Accompanying the CPI data, the Bank of Canada (BoC) will release its Core Consumer Price Index, which excludes volatile components such as food and energy costs. In January, the BoC Core CPI indicated a 0.1% monthly increase and a year-on-year rise of 2.4%.

These statistics are closely watched as they could impact the trajectory of the Canadian Dollar (CAD) and influence perceptions of the Bank of Canada’s monetary policy. Speaking of the Canadian Dollar (CAD), it has recently shown weakness against the US Dollar (USD), currently hovering around multi-session lows beyond the 1.3500 mark.

What to expect from Canada’s inflation rate?

Analysts anticipate a resurgence in price pressures across Canada in the past month. Annual changes in the Consumer Price Index (CPI) are expected to show an upward trend in February, echoing patterns seen in many of Canada’s G10 counterparts, particularly the United States. Following a peak of 4% in August, the CPI has exhibited a downward trajectory, apart from a bounce recorded in the last month of the year. Despite this, inflation indicators still hover comfortably above the Bank of Canada’s 2% target.

If the upcoming data confirms the expected rise in inflationary pressures, investors may contemplate the possibility of the central bank maintaining its current restrictive stance for a longer period than initially anticipated. However, further tightening of monetary conditions appears improbable, according to comments from bank officials.

The latter scenario would require a sudden and sustained resurgence in price pressures and a rapid uptick in consumer demand, both of which seem unlikely in the near future.

During his remarks at the latest Bank of Canada meeting, Governor Tiff Macklem expressed optimism about the ongoing fight against inflation, highlighting current progress and anticipating further advancements. He emphasized the importance of core inflation measures, suggesting that if they remain steady, the forecasts for overall inflation reduction may not materialize. Macklem assessed the risks to the inflation outlook as reasonably balanced and noted that well-anchored inflation expectations are aiding efforts to rein in inflation.

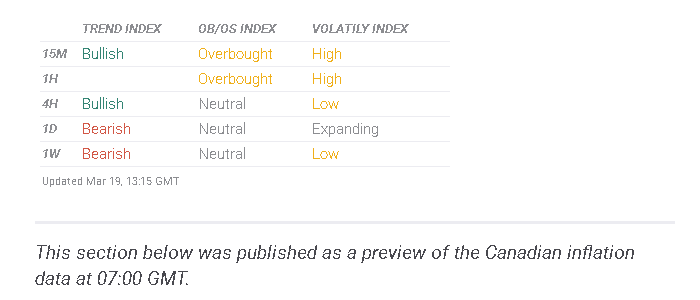

When is the Canada CPI data due and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada is scheduled to release the Consumer Price Index for February. The potential reaction of the Canadian Dollar hinges on shifts in monetary policy expectations by the Bank of Canada. However, unless there’s a significant surprise in either direction, the BoC is unlikely to alter its current cautious monetary policy stance, aligning with other central banks like the Federal Reserve (Fed).

The USD/CAD pair has kicked off the new trading year on a bullish note, though the upward momentum seems to have encountered resistance around the 1.3600 zone.

According to Pablo Piovano, Senior Analyst at FXStreet, the USD/CAD is likely to maintain a positive bias as long as it holds above the key 200-day Simple Moving Average (SMA) at 1.3479. Further bullish sentiment could strengthen with a sustained breakthrough above the year-to-date highs around 1.3600. Conversely, breaching the 200-day SMA could lead to additional losses and a potential drop to the January low of 1.3358 (January 31). Below this level, notable support levels are scarce until the December 2023 bottom of 1.3177, recorded on December 27.

Pablo also notes that significant volatility in the CAD would necessitate unexpected inflation figures. Lower-than-expected numbers might bolster arguments for potential interest rate cuts by the BoC in the coming months, potentially lifting the USD/CAD. Conversely, a rebound in the CPI, akin to trends observed in the US, could offer some backing to the Canadian Dollar, albeit to a limited extent. A higher-than-anticipated inflation reading would increase pressure on the Bank of Canada to maintain elevated rates for an extended duration, potentially posing prolonged challenges for many Canadians dealing with higher interest rates, as emphasized by Bank of Canada Governor Macklem.