- The Canadian Dollar is displaying mixed performance today but gains ground against the US Dollar.

- As Canada prepares to release its own labor market data on the same day as the US Nonfarm Payrolls (NFP) report

- ,The USD/CAD pair faces a breakdown, slipping below the key level of 1.3500 due to diminished strength in the Greenback.

The Canadian Dollar (CAD) strengthened against the US Dollar (USD) on Thursday, pushing the USD/CAD pair below the 1.3500 level. As investors brace for the eagerly anticipated US Nonfarm Payrolls (NFP) report on Friday, Canada is poised to release its own labor market data in response. While the US gears up for Daylight Savings Time this weekend, Canada’s economic calendar remains relatively quiet, with only low-tier data scheduled for the upcoming week. However, heightened market activity is expected as the focus turns to the release of February’s US Consumer Price Index (CPI) inflation next Tuesday.

Daily digest market movers: Markets pull away from Greenback as investors await key data

- Canada’s monthly Building Permits surged to a seven-month high at 13.5% in January, surpassing the 5.5% forecast and rebounding from the previous month’s -11.5% (revised from -14.0%) decline.

- US Initial Jobless Claims for the week ending March 1 slightly exceeded expectations, registering 217K compared to the forecasted 215K, with a revision from the previous week’s 215K.

- Initial Jobless Claims surpassed the four-week average of 212.25K.

- US Nonfarm Productivity in Q4 remained steady at 3.2%, matching the forecast and slightly above the expected decline to 3.1%.

- Q4 Unit Labor Costs in the US edged down to 0.4% from the previous 0.5%, missing the forecasted increase to 0.6%.

- Federal Reserve (Fed) Chairman Jerome Powell testified before the US Senate Banking Committee in the second day of a two-day Q&A session on the Fed’s Semi-Annual Monetary Policy Report.

- Canada’s Unemployment Rate is anticipated to rise from 5.7% to 5.8% on Friday.

- Canadian Net Change in Employment for February is forecasted at 20K, compared to the previous month’s 37.3K.

- Friday’s US Nonfarm Payrolls (NFP) report is expected to show 200K jobs added in February, down from January’s 11-month peak of 353K.

- NFP Preview: Forecasts from 10 major banks indicate a continued strong rise in employment.

Canadian Dollar price today

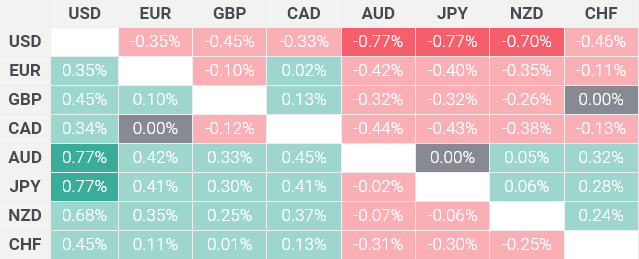

The following table illustrates the percentage fluctuations of the Canadian Dollar (CAD) against major listed currencies today, with the Canadian Dollar displaying its weakest performance against the Australian Dollar.

Technical analysis: USD/CAD drifts into the low side as Greenback waffles

The Canadian Dollar (CAD) exhibited strength against the US Dollar on Thursday, gaining approximately one-third of a percent. However, the overall performance of the Loonie was moderately weaker across the broader FX market. Notably, the CAD experienced a decrease of around half a percent against the Japanese Yen (JPY), the Australian Dollar (AUD), and the New Zealand Dollar (NZD). Meanwhile, the Canadian Dollar maintained a relatively stable position against the Euro (EUR), as both currencies struggled to establish significant movements.

In the USD/CAD pair, a near-term support level was identified at 1.3500 on Wednesday, and the bearish momentum in the US Dollar on Thursday pushed the pair towards 1.3460. This movement represents a decline of approximately one percent from the week’s peak bids at 1.3605.

The downward shift on Thursday brings the USD/CAD pair back to the 200-day Simple Moving Average (SMA) at 1.3477, with the immediate technical support marked at the last significant swing low near 1.3350.

USD/CAD hourly chart

USD/CAD daily chart