- USD/CAD recovers to 1.3500 in choppy trading.

- Canada takes a back seat with strictly low-tier data on offer.

- US CPI inflation eased but less than expected.

The Canadian Dollar (CAD) displayed a mixed performance on Tuesday, maintaining stability or posting slight gains against certain major currencies while losing ground against the US Dollar (USD). The release of higher-than-expected headline US Consumer Price Index (CPI) inflation figures contributed to reinforcing investor expectations for potential rate cuts by the Federal Reserve (Fed), which influenced the CAD’s performance.

This week, Canada’s economic calendar offers only a handful of low-impact data releases, leaving the Canadian Dollar susceptible to broader market trends. Thursday will see the release of Canadian Manufacturing Sales data for January, followed by an update on Canadian Housing Starts in February on Friday. However, neither of these releases is anticipated to have a significant impact on market sentiment.

Daily digest market movers: Uneven US CPI inflation print falls overall but less than hoped for

- In February, US Consumer Price Index (CPI) headline inflation for the year ended rose to 3.2% YoY, exceeding expectations of remaining at 3.1%.

- However, core US YoY CPI slightly decreased to 3.8% from the previous 3.9%, still higher than the median market forecast of 3.7%. Month-over-month (MoM) CPI increased to 0.4%, in line with expectations and slightly up from the previous print of 0.3%. MoM Core CPI remained unchanged at 0.4%, defying forecasts of a decline to 0.3%.

- Investor attention now turns to Thursday’s release of the US Producer Price Index (PPI) and Retail Sales figures for February. Core PPI is anticipated to ease to 1.9% from the previous 2.0%, while MoM Retail Sales are forecasted to rebound to 0.8% following the previous print of -0.8%.

- Additionally, Friday will bring the University of Michigan’s Consumer Sentiment Index for March, expected to hold steady at 76.9.

Canadian Dollar price today

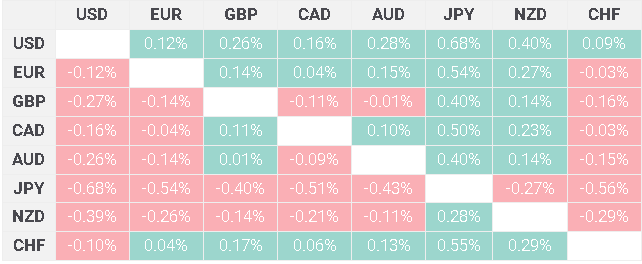

The table below displays the percentage change of the Canadian Dollar (CAD) against various major currencies today. The Canadian Dollar exhibited weakness particularly against the US Dollar.

Technical analysis: USD/CAD back into familiar technical levels near 1.3500

On Tuesday, the Canadian Dollar (CAD) experienced a slight decline of nearly a fifth of a percent against the US Dollar, while maintaining a relatively stable position against the Euro (EUR) and the Swiss Franc (CHF). However, the Antipodeans and the Japanese Yen (JPY) showed broad weakness against the CAD.

The USD/CAD pair returned to the 1.3500 level following volatile trading during the early Tuesday session. It rebounded from 1.3470 but encountered significant resistance around 1.3520. Currently, the pair is oscillating within the range bounded by supply and demand zones between 1.3450 and 1.3590.

A bullish momentum in the USD/CAD pair would likely find support around the 200-day Simple Moving Average (SMA) at 1.3478, potentially paving the way for buyers to target the 1.3600 level as the chart reflects a pattern of higher highs. Conversely, a failure to establish a foothold above the 200-day SMA could lead to a retreat towards the early February lows near 1.3360.

USD/CAD hourly chart

USD/CAD daily chart