- Canadian Dollar rises, but USD rises faster.

- Canada brings Retail Sales data to fore on Friday.

- US PMIs came in mixed on Thursday.

On Thursday, the Canadian Dollar (CAD) demonstrated overall strength against many of its major currency counterparts, although it faced a swifter uptick from the US Dollar (USD). Investors opted to scale back on selling the Greenback following a surge midweek propelled by the Federal Reserve’s actions, consequently boosting the US Dollar’s performance against various currencies.

Canada is anticipated to make a return to the economic calendar significance on Friday. Retail Sales data for January is projected to show a decrease of approximately half a percent, following a nearly full percent rise in December.

Daily digest market movers: US Dollar dominates on US data flows

- Thursday’s US S&P Global Purchasing Managers Index (PMI) data delivered a mixed outcome.

- While March’s US Manufacturing PMI surpassed expectations, rising to 52.5 from the previous 52.2, the Services PMI for the same period declined more than anticipated, dropping to 51.7 from the previous month’s 52.3, falling short of the forecasted 52.0.

- Furthermore, US Initial Jobless Claims for the week ended March 15 slipped to 210K, missing the forecasted increase to 215K from the previous week’s 212K (revised upward from 209K).

- Analysts at Scotiabank have highlighted that historically, April tends to be the Canadian Dollar’s strongest month against the US Dollar.

Canadian Dollar price today

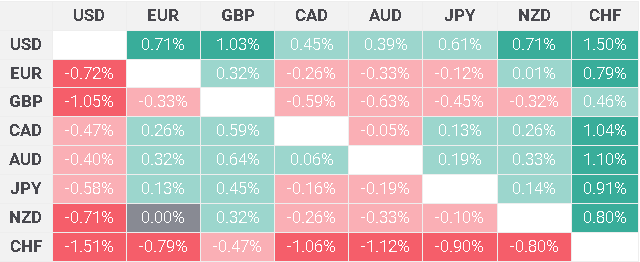

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

Technical analysis: US Dollar rebounds, bullish CAD gets outperformed

On Thursday, the Canadian Dollar (CAD) has shown strength against most major currencies, except for a slight decline of around four-tenths of a percent against the US Dollar. However, it is struggling to maintain its position against the Australian Dollar (AUD).

The USD/CAD pair is experiencing an upward trend in Thursday’s trading session, with bullish momentum pushing it up by approximately 0.6% from bottom to top. Starting from around the 1.3460 region, the pair has regained the familiar 1.3500 handle during intraday trading.

The recovery seen on Thursday marks a technical rejection from the 200-day Simple Moving Average (SMA) at 1.3485. It appears that a rangebound pattern for the USD/CAD pair is likely to persist in the near future.

USD/CAD hourly chart

USD/CAD daily chart