- BoC holds rates at 5%, doesn’t expect 2% inflation in 2024.

- Canada releases labor figures on Friday that will be overshadowed by US NFP.

- Fed Chair Powell doesn’t see recession, Greenback eases on Wednesday.

On Wednesday, the Canadian Dollar (CAD) experienced a 0.5% surge against the US Dollar (USD) following the Bank of Canada’s (BoC) decision to maintain rates at 5.0%, aligning with widespread market expectations. Federal Reserve (Fed) Chair Jerome Powell’s comments further weighed on the Greenback, as he emphasized the need for more evidence of inflation hitting the 2% target while dismissing the likelihood of a US recession.

The upcoming focal point for Canada lies in Friday’s labor figures, although the market’s primary focus is likely to be on the US Nonfarm Payrolls (NFP) report, concluding the trading week. Anticipations suggest a marginal uptick in Canada’s Unemployment Rate from 5.7% to 5.8%. As for the US, February’s NFP is projected to retreat to 200K from the January peak of 353K, marking an 11-month high.

Daily digest market movers: Canadian Dollar climbs, Greenback slides on CB-heavy Wednesday

- BoC Governor Tiff Macklem:

- Foresees a probable failure to reach 2% inflation this year.

- Notes the influence of shelter price inflation on BoC decisions.

- Indicates a strong consensus within the BoC favoring the maintenance of rates at 5%.

- Stresses the importance of uniformity across all inflation indicators.

- Confirms the governing council’s unanimous decision to uphold rates at 5%.

- Federal Reserve Chair Jerome Powell:

- Affirms no substantial reason to believe the economy is currently in or faces an imminent risk of recession.

- Emphasizes the Fed’s outlook of sustained solid growth, projecting continued progress.

- Expresses a desire for increased confidence in inflation, acknowledging some existing confidence but indicating a need for more.

- Declares in his speech that the Fed Chair does not perceive an elevated risk of recession.

- According to Canadian money markets:

- Reports a likelihood of less than 25% for a BoC rate cut in April, down from over 40% before Tiff Macklem’s Wednesday appearance.

- US ADP Employment Change:

- Falls short of expectations, registering 140K for February versus the forecasted 150K.

- Witnesses a revision upward to 111K from the previous month’s 107K.

- Canada’s seasonally-adjusted Ivey Purchasing Managers Index (PMI):

- Records a decline to 53.9 in February from the previous month’s 56.5.

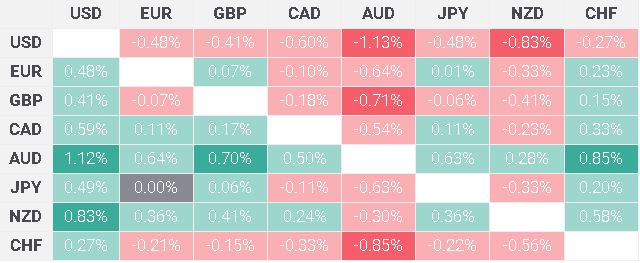

Canadian Dollar price today

The following table illustrates the percentage change of the Canadian Dollar (CAD) against various major currencies today. The Canadian Dollar demonstrated its strength, particularly against the US Dollar.

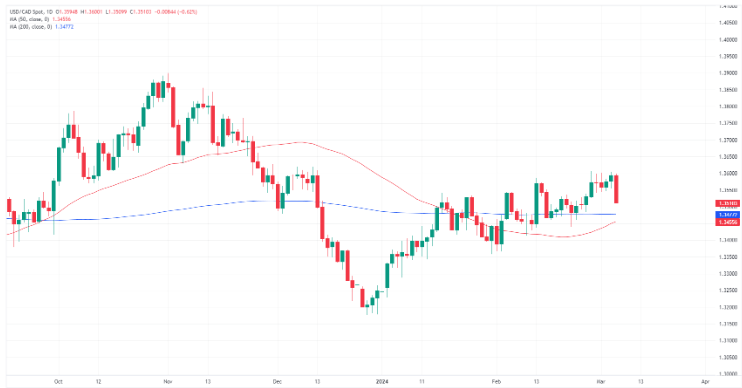

Technical analysis: Canadian Dollar surges to within reach of 1.3500 against Greenback

On Wednesday, the Canadian Dollar (CAD) exhibited broad strength, posting an increase of over half a percent against the US Dollar (USD) and approximately a third of a percent against the Swiss Franc (CHF). However, the CAD saw a decrease of around half a percent against the Australian Dollar (AUD), with the Aussie emerging as the day’s top-performing currency.

The USD/CAD pair experienced a decline to 1.3510 from Wednesday’s intraday high, which was near the 1.3600 handle. The pair is now in proximity to sliding back below 1.3500 after breaching the 200-hour Simple Moving Average (SMA) at 1.3551.

Daily candlesticks are poised to register one of their poorest performances since December, with USD/CAD recording a top-to-bottom fall of over 0.6% on Wednesday. The technical support beneath USD/CAD is situated at the 200-day SMA at 1.3477.

USD/CAD hourly chart

USD/CAD daily chart