- Canadian Dollar is mostly flat on Friday with limited momentum.

- Housing Starts in Canada since November ticked higher.

- Next week: Canadian CPI inflation, US Fed rate call.

The Canadian Dollar (CAD) mostly held onto its gains against the US Dollar (USD) on Friday, remaining within the day’s opening range as traders awaited developments ahead of the weekend. Despite the University of Michigan US Consumer Sentiment Index dipping slightly early in the American trading session and Canadian Housing Starts hitting their highest level since November, market reaction remained muted.

Looking ahead, Canada is set to release February’s Consumer Price Index (CPI) inflation figures on Tuesday, while attention will quickly turn to the Federal Reserve (Fed) for its latest rate statement on Wednesday, which will also include updates to its Dot Plot projection of interest rate expectations for the next one to five years.

Additionally, next week will see the release of the latest US Manufacturing Purchasing Managers Index (PMI) on Thursday, followed by Canadian Retail Sales and the US Services PMI component on Friday. Initial median market forecasts suggest a slight decrease in the US Manufacturing PMI, while Canadian Retail Sales are expected to decline.

Daily digest market movers: Data drives little chart movement, investors buckle down for the wait to Fed

- Seasonally-adjusted Canadian Housing Starts for the year ending in February surged to 253.5K, surpassing both the forecast of 230K and the previous period’s 223.2K (revised down from 223.6K).

- In January, Canadian Wholesale Sales also rebounded modestly by 0.1%, bouncing back from the forecast of -0.6%. The previous month’s Wholesale Sales were revised to -0.3% from 0.3%. However, such nearly flat adjustments in this indicator are unlikely to instill significant investor confidence.

- The University of Michigan’s US Consumer Sentiment Index saw a slight decline in March, slipping to 76.5 compared to the market’s anticipated hold at the previous 76.9.

- Meanwhile, UoM 5-year Consumer Inflation Expectations in March remained unchanged at 2.9%, indicating persistent skepticism among US consumers regarding the Fed’s ability to bring inflation below 2%.

- In February, US MoM Industrial Production saw a modest recovery of 0.1%, defying the market’s forecast of 0.0%. However, the previous month’s Industrial Production was revised down to -0.5% from the initial print of -0.1%.

- Looking ahead, next Tuesday’s Canadian CPI for the year ended February is expected to rise to 3.1% from the previous 2.9%. The Bank of Canada’s (BoC) Core Consumer Price Index (CPI) last stood at 2.4%.

- Additionally, Canadian Retail Sales are projected to contract, with markets anticipating a -0.4% print versus the previous 0.9%.

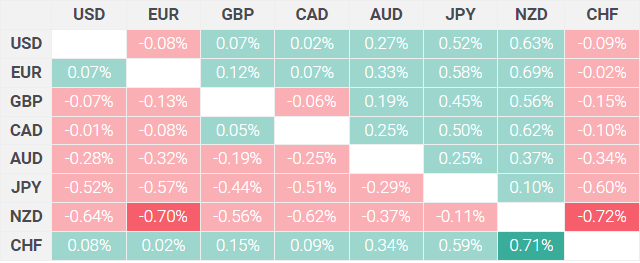

Canadian Dollar price today

The table below displays the percentage change of the Canadian Dollar (CAD) against various major currencies today. The Canadian Dollar exhibited the most strength against the [mention the currency against which CAD was strongest].

Technical analysis: Flat Friday trading as Canadian Dollar struggles to pare losses against Greenback

On Friday, the Canadian Dollar (CAD) showed mixed to flat performance, remaining within proximity of the day’s opening levels against the US Dollar, Euro (EUR), and Swiss Franc (CHF). Against the Pound Sterling (GBP), the CAD edged up by around 0.10%, while it recorded an increase of approximately 0.50% against the Japanese Yen (JPY).

In intraday trading, the USD/CAD pair hovered on the higher side of 1.3500, with its early-day peak near 1.3550 and sellers struggling to push the pair below the 1.3510 mark. A potential pullback floor is observed in a near-term supply zone around 1.3460, while intraday bids encounter resistance near 1.3550, which has now turned into a support-turned-resistance level.

USD/CAD hourly chart