Following a short roller coaster journey, AUD/USD is currently trading at a level equivalent to that observed at the conclusion of November. Analysts at Commerzbank are examining the outlook for this currency pair.

Cautious RBA provides support

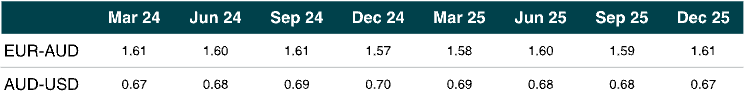

There is a prevailing belief that the Australian Dollar (AUD) could experience a rebound in the months ahead. Anticipated rate cuts are expected to commence later than in the United States, and the Reserve Bank of Australia (RBA) is deemed to have the flexibility to implement them, considering the dynamics of the real economy. Despite a deceleration in economic growth, the likelihood of avoiding a recession remains. This divergence in monetary policy is seen as a factor contributing to the upside potential for AUD/USD until the close of the year.

Certainly, there remains the possibility that the Reserve Bank of Australia (RBA) might opt for rate cuts earlier than anticipated, presenting a notable risk to our forecast. The labor market, in particular, deserves attention. Although there has been a recent deceleration in the labor market, albeit from robust levels, recent statements from officials indicate that it may not yet be sufficient to justify earlier rate reductions. Nonetheless, this is a factor to monitor closely in the forthcoming months.

By the latest, towards the end of the year, sentiment is anticipated to shift. This projection aligns with our economists’ expectation of a brief period of weakness in the US economy, succeeded by a robust rebound. Consequently, the Federal Reserve is likely to implement only marginal interest rate cuts next year, contrary to prevailing market expectations, ultimately favoring the USD. As a consequence, we have made a slight adjustment to our AUD/USD forecast for 2025.