- EUR/GBP experiences a decline following projections of a slowdown in Eurozone growth for 2024, while UK growth receives an upward revision.

- The European Central Bank (ECB) concludes its March policy meeting, coinciding with the delivery of the spring budget by the UK Chancellor.

- The technical outlook suggests a bearish trend, albeit with significant considerations.

Experiencing a decrease of more than 0.1%, the Euro (EUR) is currently trading in the 0.8540s against the Pound Sterling (GBP) on Thursday. This decline is attributed to disparate growth forecasts for the Eurozone and the UK economy.

EUR/GBP slides on diverging growth stories

In Frankfurt, the European Central Bank (ECB) wrapped up its March policy meeting and decided to maintain unchanged interest rates. Despite this, the ECB staff projections revealed a less optimistic outlook for future growth and inflation, with the projected growth rate averaging 0.6% for the region in 2024 and inflation at 2.3%. These figures fell below the ECB’s prior forecasts of 0.8% and 2.7%, respectively.

On the other side of the channel in Britain, the UK’s Chancellor of the Exchequer, Jeremy Hunt, struck a more positive tone. Presenting the spring budget to the House of Commons, Hunt estimated a stronger growth of 0.8% for the UK economy in 2024, surpassing the 0.7% forecast by the Office for Budget Responsibility (OBR) in November. Although Hunt’s viewpoint may not be entirely independent, the upward revision in forecasts likely contributed to short-term strength in GBP.

The outcome appears to have resulted in a minor depreciation of the Euro against the Pound, as reflected in the EUR/GBP exchange rate.

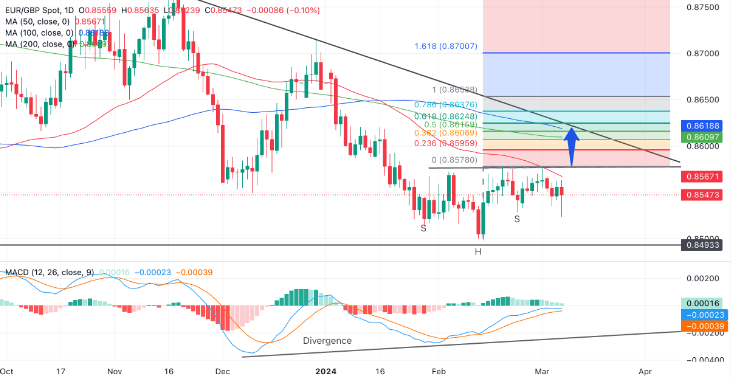

Technical Analysis: Possible Inverse Head and Shoulders

The extended technical perspective for the pair suggests a sideways trajectory, leaning slightly towards a bearish bias in both the intermediate and short-term.

Simultaneously, observations on the daily chart suggest that there might be potential for the pair to reverse its bearish trend and initiate a recovery. However, definitive confirmation from price action is necessary before any conclusive shift in the bearish outlook can be asserted.

The initial indication emerges from the Moving Average Convergence/Divergence (MACD), which is converging bullishly with price action, hinting at the potential for a forthcoming recovery.

While February witnessed a lower low compared to December 2023 in price action, the MACD displayed a higher low during the second trough in February. This nonconfirmation and convergence between the indicator and the exchange rate serve as bullish signals.

Adding to the bullish signs is the possibility that EUR/GBP may have established a bottoming pattern, identified as an Inverse Head and Shoulders (H&S), during January and February. This formation suggests a potential reversal on the intermediate time frame.

If the Inverse H&S materializes, a breakout would occur when the price surpasses the “neckline,” marked by a resistance line at the highs, positioned at 0.8750 for EUR/GBP.

Upon breaking above the neckline, the subsequent rise could either be equivalent to the pattern’s height projected higher or extend to the Fibonacci 61.8%.

Despite the potential for upward movement, it’s noteworthy that the confluence of resistance from the 100 and 200-day Simple Moving Averages (SMA) around 0.8615, along with resistance from the nearby trendline, presents a conservative estimate for the pattern. However, the possibility of a higher move exists, especially if accompanied by a significant shift in fundamentals.