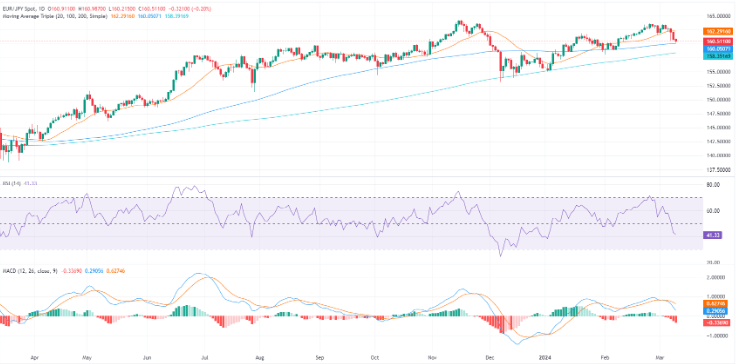

- Daily chart analysis reveals heightened selling pressure with the RSI and MACD deep in the negative zone.

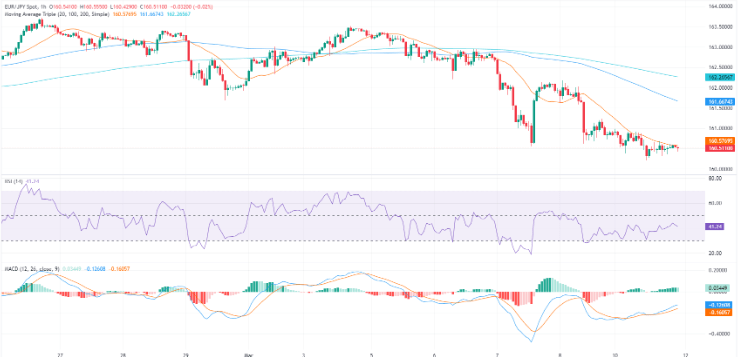

- The hourly chart saw a short-lived recovery in the indicators.

- Although the pair has experienced recent declines, its positioning above the key SMAs signals an ongoing bullish outlook.

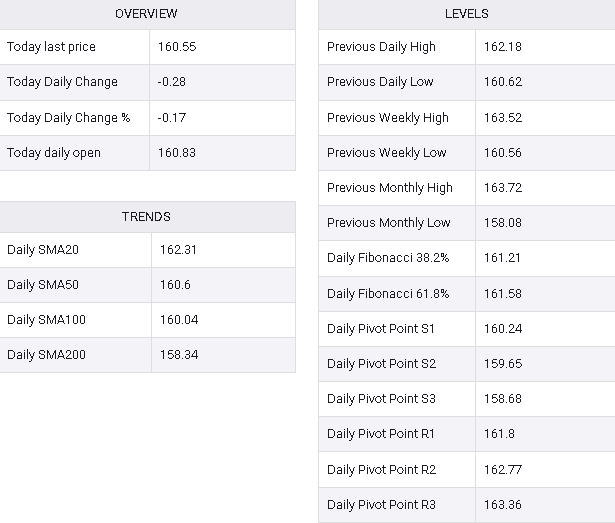

During Monday’s trading session, the EUR/JPY pair is positioned at 160.57, reflecting a daily decline of 0.19%. Despite ongoing fluctuations, it is evident that sellers are currently curbing the strength of buyers. The brief recovery observed in shorter time frames appears to be losing momentum.

On the daily chart, the Relative Strength Index (RSI) is situated around 41, indicating robust selling pressure. The RSI had been in positive territory a week ago, reaching a peak of approximately 65, but has since shifted into a downtrend as sellers took control. Simultaneously, the Moving Average Convergence Divergence (MACD) histogram is displaying increasing red bars, signaling a growth in negative momentum.

EUR/JPY daily chart

Examining the hourly chart of EUR/JPY, the Relative Strength Index (RSI) closely mirrors the daily chart, hovering around 40 after briefly reaching oversold conditions earlier in the session. In addition, the Moving Average Convergence Divergence (MACD) histogram reveals diminishing green bars, signifying a reduction in the previously established buying momentum.

EUR/JPY hourly chart

Taking a broader perspective, the EUR/JPY pair, despite experiencing recent declines, continues to trade above the 100 and 200-day Simple Moving Averages (SMAs). This indicates that on more extended time frames, a bullish sentiment prevails.

EUR/JPY