- EUR/JPY slips to 160.86 in response to speculations surrounding the Bank of Japan contemplating the cessation of negative interest rates.

- According to technical analysis, a potential extended decline may ensue if the pair concludes below the 161.31 Kijun-Sen level.

- On the flip side, a resurgence beyond 161.00 might indicate a recovery towards the 162.00 threshold, with attention directed towards the March 7 high.

For the second consecutive day, the EUR/JPY experiences a decline, marking a 0.64% loss in early trading within the North American session. Growing speculations about the Bank of Japan (BoJ) considering an end to negative interest rates contribute to a strengthening of the Japanese Yen (JPY) against several G7 currencies. As of the current update, the pair is trading at 160.86.

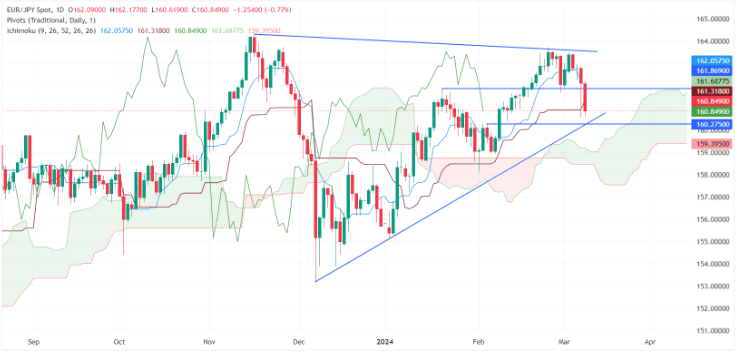

EUR/JPY Price Analysis: Technical outlook

Despite hitting a three-week low, the EUR/JPY exhibits a slight upward inclination. However, a scenario where sellers successfully achieve a daily close below the Kijun-Sen at 161.31 could trigger a more pronounced pullback. The subsequent support levels to watch include the psychological level of 160.00, followed by the Senkou Span B at 159.39, and the upper boundary of the Ichimoku Cloud (Kumo) around 159.00/15.

Conversely, if buyers manage to push the exchange rate above 161.00 and reclaim the Kijun-Sen, it could set the stage for an upward move towards 162.00. Once surpassed, attention should turn to a potential test of the March 7 high at 162.81.

EUR/JPY Price Action – Daily Chart

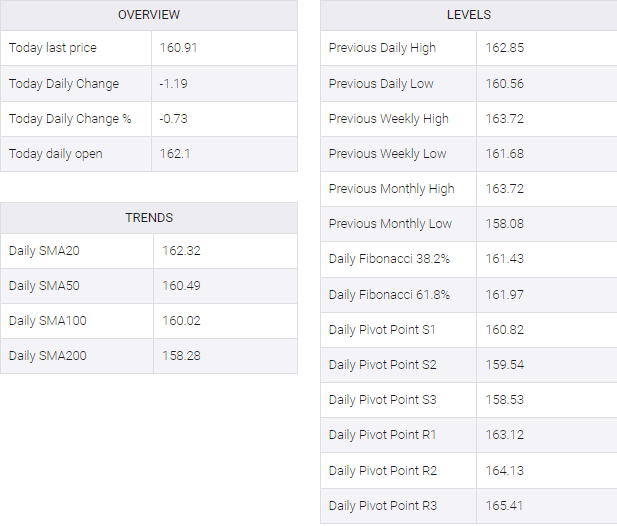

EUR/JPY