- EUR/USD is directing its attention towards surpassing the auction range beyond 1.0850, propelled by a decline in the US Dollar.

- Anticipations of Federal Reserve rate cuts in June have arisen following the release of lackluster US Manufacturing PMI data.

- The Eurozone’s significant monthly inflation expansion has alleviated early expectations for a rate cut by the ECB.

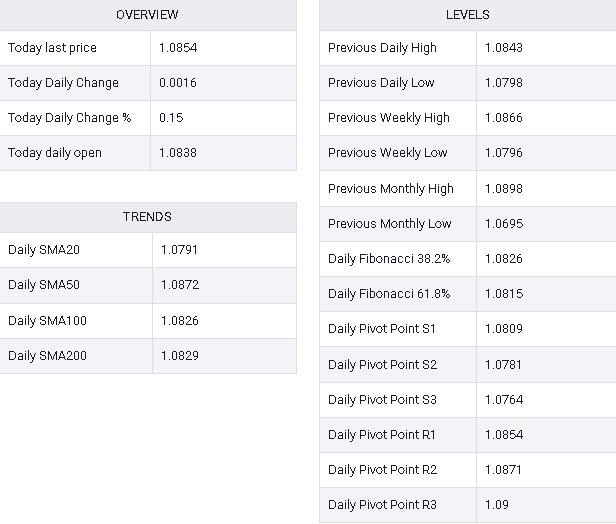

The EUR/USD pair is targeting a move beyond the critical resistance level of 1.0850. Strengthening against the US Dollar, the major currency pair advances, while diminishing prospects of prompt rate cuts by the European Central Bank (ECB) contribute to the positive momentum.

The market displays a sense of disarray with S&P 500 futures experiencing a slight dip, juxtaposed with commendable performance by risk-sensitive currencies. The US Dollar Index (DXY) declines to 103.80, fueled by heightened expectations of a Federal Reserve (Fed) rate cut.

According to the CME FedWatch tool, there is a 58% probability of a 25 basis points (bps) interest rate reduction in the upcoming June policy meeting. Prior to the release of February’s ISM Manufacturing PMI data last Friday, the expectations for a rate cut stood at 53%.

The Manufacturing PMI reported by the ISM is 47.8, falling below both the anticipated 49.5 and the previous reading of 49.1. The agency notes a substantial decline in the fresh factory orders index, signaling a halt in the recovery of the Manufacturing PMI.

Looking ahead, market participants will closely attend to Fed Chair Jerome Powell’s congressional testimony, anticipating his reaffirmation of the necessity for compelling evidence confirming that inflation is progressing towards the 2% target.

In the Eurozone, unexpectedly robust preliminary inflation figures for February have delayed projections of imminent rate cuts by the ECB. Concerns about sustained inflation intensified as both the monthly headline and core inflation data exhibited significant growth, standing at 0.6% and 0.7%, respectively.

EUR/USD