- The EUR/USD pair is bouncing back after experiencing losses in the wake of Tuesday’s US inflation report.

- Although the short-term upward trend is now uncertain, the downward movement lacks significant momentum.

- Analysts at TD Securities are maintaining their prediction of a Fed rate cut in June.

During the early US session on Wednesday, EUR/USD has garnered support after initially weakening post the release of higher-than-anticipated inflation figures from the United States (US) on Tuesday. The robust inflation data has diminished the likelihood of an imminent interest-rate cut by the Federal Reserve (Fed).

Currently trading in the 1.0940s during the US session, the pair has retreated from its recent peak in the 1.0980s recorded last Friday.

Investor sentiment has shifted away from expectations of a May interest-rate cut by the Fed, with focus now redirected towards June.

Given that prolonging higher interest rates tends to bolster the US Dollar (USD) by attracting increased capital inflows, the release of the US Consumer Price Index (CPI) data has spurred gains for the Greenback across most pairs, including EUR/USD.

EUR/USD unphased after Eurozone Industrial Production plunges

Eurozone Industrial Production experienced a more pronounced downturn than anticipated, registering a 3.2% month-on-month decline in January. This contrasts with the downwardly revised 1.6% drop in December and falls below the expected negative 1.5%, as per data released by Eurostat on Wednesday.

Described as the most significant activity contraction since March of the preceding year, this decline marks the second-largest drop since the aftermath of the COVID-19 outbreak in April 2020. The notable factor contributing to this downturn is a remarkable 14.5% decrease in the production of capital goods, as reported by Tradingeconomics.com.

Despite these significant figures, EUR/USD has exhibited minimal reaction to the release, maintaining its trading range in the 1.0920s following the data announcement.

EUR/USD: June still on for first rate cut, TD Securities says

Despite Tuesday’s hot inflation data, economists at TD Securities have solidified their view that June is the month for the liftoff. They anticipate services inflation to continue “normalizing,” as stated in a recent note.

Following the release of the February CPI, they remarked, “We don’t believe today’s report significantly alters the Fed’s inclination to initiate easing by the June FOMC meeting.”

Elaborating further, they stated, “In our assessment, services inflation is expected to steadily revert to a normalized trajectory over the next several months, particularly as we move past the more challenging seasonal period.”

Their outlook predicts a weakening of the US Dollar in the second and third quarters, which could potentially exert upward pressure on EUR/USD, unless the Euro (EUR) experiences similar setbacks.

Technical Analysis: EUR/USD continues correction lower

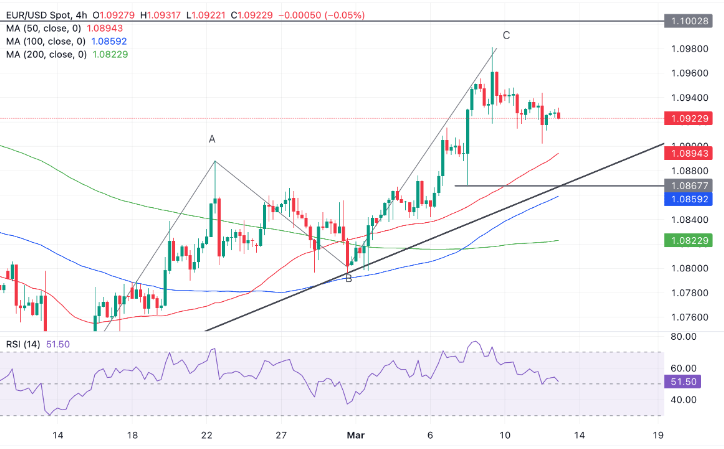

On Tuesday, EUR/USD experienced another downward move, continuing its descent from the peak of 1.0981 reached on March 8th.

This recent decline adds to a series of diminishing peaks and troughs, casting uncertainty on the previously observed short-term uptrend.

However, the downward movement lacks significant momentum and has exhibited a slower pace compared to the preceding upward trend, implying that it might be more of a correction rather than a complete reversal of the prior uptrend.

There remains a possibility for the correction to extend further downward. One potential area where price might discover support lies between the high of 1.0898 observed on February 2nd and the top of the Measured Move’s A wave at 1.0888.

A breach beneath the level of 1.0867 would likely strengthen the argument for a trend reversal and potentially empower bearish sentiment.

Resumption of uptrend

To confirm a continuation of the uptrend, a breach beyond the 1.0955 mark would be necessary. Specifically, surpassing the March 8 high of 1.0981 would provide substantial confirmation, establishing a higher high.

Following this, formidable resistance is anticipated at the psychological barrier of 1.1000, likely sparking intense trading activity between bullish and bearish forces.

However, a definitive breakthrough above 1.1000 would signify significant momentum and pave the way for further advances towards the critical resistance level at 1.1139, representing the high of December 2023.

When referring to a “decisive” break, it implies either a single long green candle distinctly piercing above the level and closing near its peak, or three consecutive green bars surpassing the level, indicating a solid breach.