- Euro sheds 1.3% top-to-bottom in broad-market pullback into USD.

- Upbeat German data couldn’t keep the Euro afloat.

- US GDP and PCE inflation to be key data prints next week.

The EUR/USD continued its downward trajectory on Friday, as investors opted to favor the US Dollar despite stronger-than-expected German economic data. Mid-tier sentiment indicators from Germany surpassed expectations, showing improvements in consumer, investor, and business sentiment. Nevertheless, the persistence of mediocre to soft economic data from Europe remains a significant obstacle to overly bullish sentiment.

Federal Reserve (Fed) Chairman Jerome Powell delivered a speech during a Fed Listens event in Washington, DC. However, Powell refrained from delving into monetary policy issues, leaving investors eager for rate cuts with little new information to digest over the weekend.

Looking ahead to next week, market attention will be focused on US Gross Domestic Product (GDP) figures scheduled for Thursday, along with a release of the Personal Consumption Expenditure (PCE) Price Index on Friday. Investors, particularly those anticipating imminent Fed rate cuts, will closely monitor US economic growth trends. The Core Month-over-Month (MoM) PCE Price Index, the Fed’s preferred inflation gauge, is expected to moderate to 0.3% from the previous 0.4%.

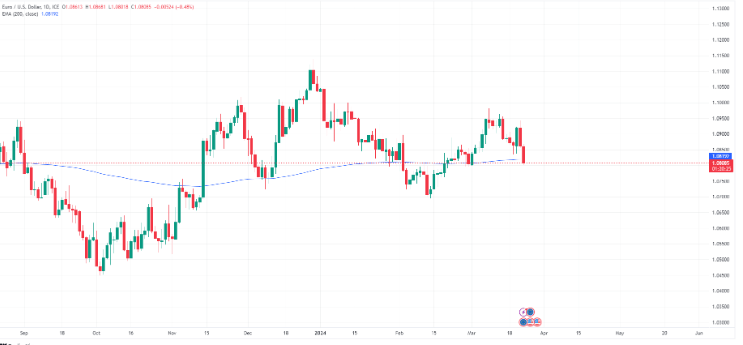

EUR/USD technical outlook

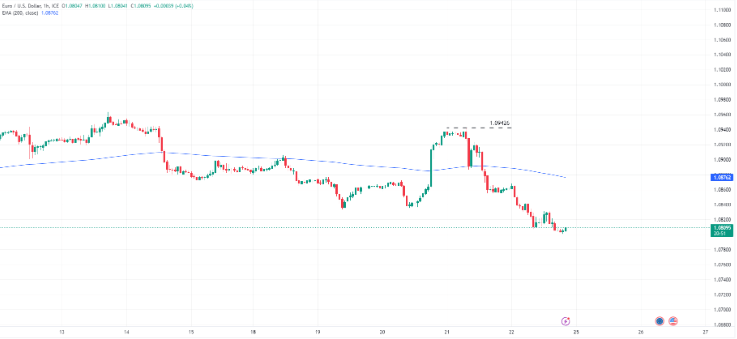

EUR/USD reached a weekly peak of 1.09426 on Thursday before sliding back towards the 1.0800 level by the Friday market close. The pair experienced a decline of nearly 1.3% from its high to low, reaching its lowest levels since the start of March.

Daily candlesticks have retreated to the 200-day Exponential Moving Average (EMA) around 1.0820, suggesting the potential for further downward movement towards the previous swing low near 1.0750.

EUR/USD hourly chart

EUR/USD daily chart