- On Thursday, the EUR/USD pair experienced a decline following the release of US macroeconomic data.

- Factory gate prices in the US surged beyond expectations in February, signaling heightened inflationary pressures.

- Although Retail Sales saw an increase, they fell short of estimates, while Initial Jobless Claims showed a decline.

- In Europe, a lineup of ECB speakers is anticipated, potentially offering insights into interest rate policy.

On Thursday, the EUR/USD pair weakened, reaching the lower 1.0900s following the release of US macroeconomic data, which pointed to ongoing inflationary pressures within the economy.

US Factory gate inflation exceeded expectations in February, while Retail Sales data showed an increase but fell short of estimates. Additionally, US Initial Jobless Claims were lower than anticipated and also slightly lower than previous figures. Collectively, the data depicted a picture of a resilient economy.

These data releases have tempered expectations regarding the timing of potential interest rate cuts by the Federal Reserve (Fed), which is a significant factor influencing the US Dollar (USD). It now appears more probable that policymakers will aim to maintain higher interest rates for a prolonged period until they observe a decline in inflationary pressures.

Meanwhile, in Europe, a series of statements from European Central Bank (ECB) rate-setters are scheduled, expected to provide insights into when the central bank might opt to initiate interest rate cuts—a pivotal factor influencing the Euro (EUR).

EUR/USD Daily digest market movers: US data and Euro-speak

According to the latest data from the US Bureau of Labor Statistics released on Thursday, the Core Producer Price Index (PPI), excluding food and energy, surged by 2.0% in February, exceeding the forecasted 1.9%. This figure remained unchanged from the previous month’s reading of 2.0% in January.

On a monthly basis, the Core PPI showed a 0.3% increase in prices, outperforming the expected 0.2% rise, although it was lower than the 0.5% increase recorded in the previous month.

The headline Producer Price Index (PPI) climbed by 1.6% in February, surpassing the anticipated year-on-year gain of 1.1% and the previous month’s 1%. Meanwhile, the month-on-month PPI rose by 0.6%, in line with the forecasted 0.6% increase and matching the previous month’s figure of 0.3%.

US Retail Sales experienced a 0.6% increase month-on-month, slightly lower than the forecasted 0.8% rise but still higher than the 0.8% decline reported in January.

Finally, for the week ending March 8, US Initial Jobless Claims came in at 209K, lower than the forecast of 218K, although slightly below the previous week’s figure of 210K.

ECB speakers shed light on whether interest rates will fall in April or June

Dovish sentiment emanating from ECB Governing Council (GC) influential figures has created a divide regarding the timing of the first interest-rate cut by the Frankfurt-based bank.

Francois Villeroy de Galhau, a significant member of the GC, hinted on Monday towards favoring April for the initial rate cut.

Contrary to this, Robert Holzmann, Governor of the Bank of Austria and GC member, expressed a belief on Wednesday that a rate cut is more likely to occur in June. This sentiment was echoed by ECB President Christine Lagarde, who also mentioned June as the period for the ECB to review its rate policy.

Thursday saw ECB Governing Council member Yannis Stournaras advocating for an early rate cut, dismissing arguments against the ECB acting before the Federal Reserve. Stournaras deemed four rate cuts in 2024 as reasonable.

Similarly, Klaas Knot, another ECB Governing Council member, voiced his anticipation of interest rate cuts commencing in June.

Pablo Hernandez de Cos, Governor of the Bank of Spain and GC member, is yet to address the issue at an event in Madrid. He will be followed by ECB Vice-President Luis de Guindos.

The prevailing sentiment suggests a tilt towards June as the probable timing for rate cuts, potentially exerting a mildly positive impact on the Euro and EUR/USD. However, if the camp led by De Galhau gains momentum, it could lead to a weakening of the EUR/USD pair.

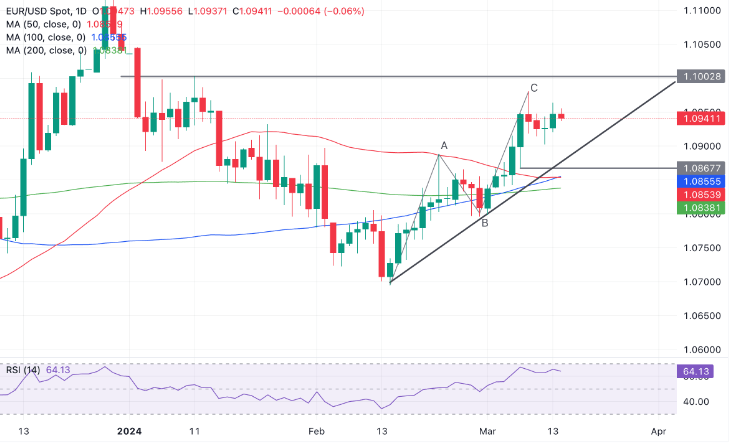

Technical Analysis: EUR/USD continues correction lower

EUR/USD remains in a retracement phase following its peak at the 1.0981 level on March 8.

The pullback is currently displaying a lack of significant momentum, and Wednesday’s upward movement provides further indication that the pair is likely undergoing a correction within its prevailing short-term uptrend, rather than initiating a reversal of that trend.

At present, it appears probable that the pair will establish a support level and ultimately resume its upward trajectory.

The ongoing correction may potentially deepen before reaching completion. A probable area for price support lies between the February 2 high at 1.0898 and the peak of the Measured Move’s A wave at 1.0888.

Should the pair breach the critical level of 1.0867, it would lend substantial weight to the argument for a reversal in trend, indicating a shift towards bearish control.

Conversely, a move above 1.0981 would confirm the establishment of a higher high, signaling an extension of the existing uptrend. Following this, formidable resistance is anticipated at the psychological barrier of 1.1000, likely marking a significant battleground between bullish and bearish forces.

A decisive breakthrough above 1.1000—characterized by a substantial green candle piercing the level and closing near its peak, or the occurrence of three consecutive green bars surpassing the level—would pave the way for further upward momentum toward the pivotal resistance level at 1.1139, last seen in December 2023.