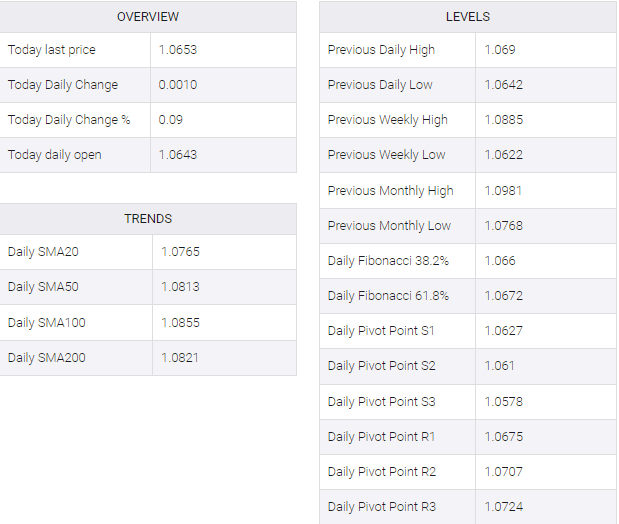

- The Euro is holding above the support level at 1.0600, but its attempts to rally are limited below 1.0690.

- The overall bias continues to favor the bearish trend observed since early March, when the pair peaked near 1.1000.

- The contrasting monetary policy outlook between the ECB and the Fed is anticipated to maintain downward pressure on the pair.

This week, Euro bears found support around the 1.0605 level, but the pair remained in a sideways trading pattern, with upward movements restricted below 1.0690. Despite this, the pair is poised to end the week with minimal changes, following a 1.8% decline in the previous week.

A slightly weaker US Dollar provided some relief to the Euro on Friday, though the overarching bearish trend persists. The contrasting monetary policy stances between the ECB and the Fed are anticipated to exert downward pressure on the pair.

Recent data reaffirms the view of a steady trajectory for the US economy, bolstering the case for a more hawkish stance from the Fed. Chicago Fed President Austen Goolsbee highlighted on Friday that progress on inflation has stalled, suggesting a prolonged path to achieve the 2% target. Consequently, the Dollar saw a modest uptick in response.

In contrast, ECB President Lagarde hinted at potential interest rate cuts in June, signaling proactive measures from the European Central Bank ahead of the Fed. This unusual stance is expected to weigh on the Euro moving forward.

EUR/USD