- EUR/USD surges to the day’s peak following the release of lackluster US Nonfarm Payrolls, which exerts downward pressure on the US Dollar.

- Unexpected declines in both Average Hourly Earnings and the Unemployment Rate contribute to the USD weakness.

- Simultaneously, remarks from European Central Bank (ECB) officials resurface the prospect of an earlier-than-expected rate cut, creating additional strain on the Euro.

EUR/USD climbs to daily highs in the 1.0970s on Friday following the release of US Nonfarm Payrolls, which reveals disinflationary wage data and an unexpected increase in the Unemployment Rate for February.

The pair rebounds after a slight decline, which ensued after comments from European Central Bank (ECB) officials reignite the possibility of an early interest-rate cut in April.

EUR/USD rebounds after Nonfarm Payrolls

The EUR/USD experienced a notable surge on Friday following the release of US Nonfarm Payrolls, which revealed an unexpected decline in Average Hourly Earnings and an increase in the Unemployment Rate. These indicators suggest that the Federal Reserve (Fed) might initiate rate cuts earlier than previously anticipated.

Despite the headline Nonfarm Payrolls figure indicating the addition of 275,000 jobs in February, surpassing the expected 200,000, other metrics in the Bureau of Labor Statistics (BLS) report pointed to weaknesses in the labor market.

Average Hourly Earnings, a crucial component of inflation, recorded a lower-than-anticipated year-on-year increase of 4.3% and a monthly rise of 0.1%, falling below the predicted 4.4% and 0.3%. Concurrently, the Unemployment Rate rose to 3.9%, exceeding the expected 3.7%.

This data implies reduced inflationary pressure from wages and a higher-than-expected unemployment rate, potentially prompting the Fed to expedite interest rate cuts earlier in the year. Lower interest rates are viewed negatively for the Dollar, as they diminish foreign capital inflows.

Euro pressured by comments from ECB officials

The Euro faced downward pressure on Friday following statements from Governor of the Bank of France and ECB Governing Council member Francois Villeroy de Galua. He indicated that a rate cut in spring is now “very likely,” specifying that “spring goes from April to June.” This dovish sentiment was echoed by ECB colleague Joachim Nagel, Bundesbank President, who mentioned an increasing probability of an interest-rate cut before the summer break, contingent on data, with improved prospects.

These dovish remarks contrast with the more cautious stance expressed by ECB President Christine Lagarde after the ECB meeting on Thursday. Lagarde suggested that June would be the next key date for reviewing policy on interest rates. The Euro is declining as lower interest rates diminish the attractiveness of the currency for foreign investors to park their capital.

EUR/USD is currently in a short-term uptrend, driven higher by the perception that the US Federal Reserve (Fed) is closer to potential interest rate cuts compared to the European Central Bank (ECB).

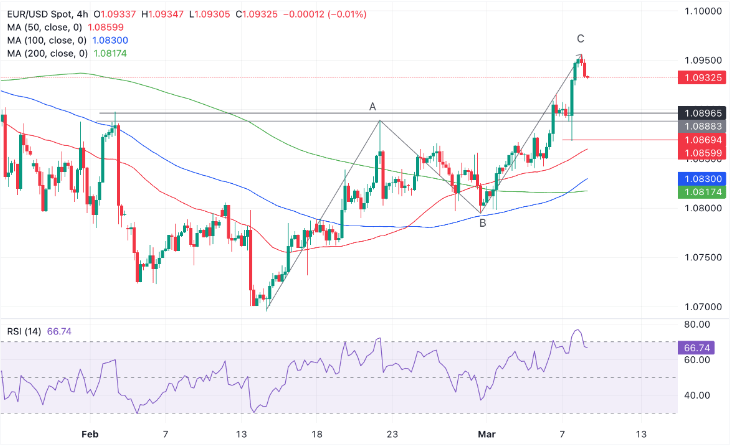

Technical Analysis: Euro recovers after pulling back

Looking at the charts, the EUR/USD has climbed to the 1.0900s from the base-camp lows around 1.0600 in February. The pattern of ascending peaks and troughs indicates a tentative short-term uptrend is underway, slightly favoring the bulls.

However, there are indications that a pullback might be in progress. The Relative Strength Indicator (RSI) has exited the oversold zone, signaling a sell. Additionally, there is a suggestion that the pair may have completed a three-wave ABC measured move pattern, reaching the recent highs of 1.0956. This provides further evidence that a correction may be unfolding.

While these signals may not yet signify a complete reversal of the short-term uptrend, they do suggest that a pullback is in progress. The anticipated support zone for the correction lies between the February 2 high at 1.0898 and the top of the A wave at 1.0888.

Should the pair breach the red line at Thursday’s lows of 1.0867, it would indicate a higher likelihood of a reversal.

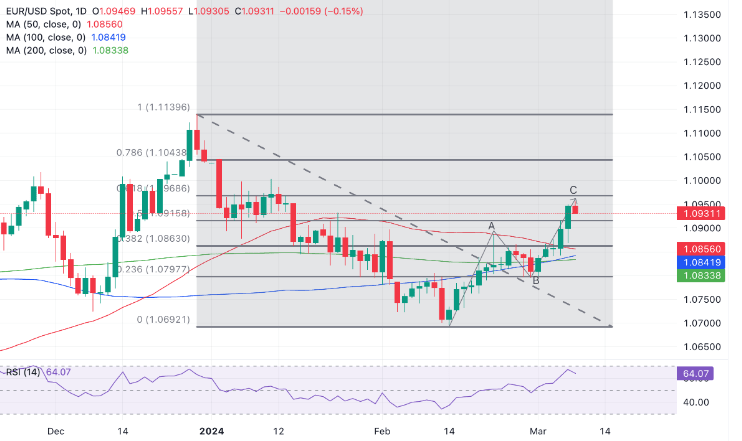

On the daily chart, there is also a probability that the pair is now in an intermediate uptrend, although further confirmation would be needed through another upward move following the ongoing pullback.

The RSI on the daily chart is not as overbought as observed on the 4-hour chart, suggesting that there is still potential for further upside before the market becomes excessively bullish.

If the uptrend resumes, the next target to the upside is the crucial 0.618 Fibonacci retracement of the early 2024 decline, positioned at 1.0972. A breakthrough beyond this level would encourage bulls to aim for the psychological milestone of 1.10, followed by 1.1043 at the 0.786 Fibonacci retracement.

However, a dip below the 1.0795 lows would disrupt the positive momentum and indicate a susceptibility to a breakdown in the market.