- EUR/USD slumps after German and Eurozone PMI data show contraction in Manufacturing.

- The move pares gains made after the dovish hold by the Fed weakened the US Dollar.

- The Fed continues to expect to make three 0.25% interest rate cuts in 2024, same as December.

On Thursday, the EUR/USD pair dipped by 0.5% into the 1.0800s following the unveiling of PMI data from both the US and Eurozone, alongside US Initial Jobless Claims and Philadelphia Fed Manufacturing figures. Notably, the US data surpassed expectations across the board. This pullback reversed some of the earlier gains spurred by the Federal Reserve’s recent announcement to keep interest rates steady, coupled with its indication of potential rate cuts thrice throughout 2024.

EUR/USD retreat deepens after release of US data

Following the release of robust US PMI data for March, along with favorable Initial Jobless Claims and the Philadelphia Fed Manufacturing Index, the EUR/USD pair extended its decline, nearing the day’s lows in the 0.6580s.

The US S&P Global Composite PMI remained solid at 52.2, maintaining its expansionary stance above the pivotal 50 level. Additionally, the US Manufacturing PMI outperformed expectations and prior figures, registering at 52.5. However, the Services PMI fell short of forecasts and previous results, posting a March figure of 51.7.

Moreover, the Philadelphia Fed Manufacturing Survey surpassed estimates, reporting a reading of 3.2, while Initial Jobless Claims came in lower than the anticipated 215K at 210K. These collectively bolstered the US dollar and exerted downward pressure on the EUR/USD pair.

EUR/USD rotates lower after Manufacturing PMI weighs

The EUR/USD pair retraced its post-Fed rally following the release of Eurozone HCOB PMI data, presenting a mixed picture of growth across the region. While the Composite PMI climbed to 49.9, surpassing estimates of 49.7 and February’s reading of 49.2, a surprising downturn in the Manufacturing sector marred the overall outlook.

In March, the Eurozone’s HCOB Manufacturing PMI plummeted to 45.7, plunging further into contraction territory below the 50 threshold, diverging from the anticipated rise to 47.0 from the previous 46.5.

Conversely, the HCOB Services PMI in the Eurozone ascended to 51.1, outperforming projections of 50.5 and the previous reading of 50.2, according to data from S&P Global.

Meanwhile, Germany, the economic powerhouse of Europe, echoed a similar narrative, with its HCOB Manufacturing PMI sliding to 41.6, below estimates of 43.1 and February’s 42.5. Nevertheless, unexpected gains were observed in both the Services component and the Composite figure.

The euro’s depreciation following the data release was attributed to the “Deeper manufacturing contraction both in Germany and the EU,” as noted by Dhwani Mehta, a senior analyst at FXStreet.

Fed maintains status quo

During its Wednesday policy meeting, the Federal Reserve opted to maintain the Fed Funds Rate at the widely anticipated range of 5.25%-5.50%. In its accompanying Summary of Economic Projections (SEP), the Fed reiterated its outlook for rates to decrease to a median target of 4.6% in 2024, consistent with its December forecast.

This projection suggests an expectation of approximately three 25 basis points (0.25%) rate cuts throughout the year, despite speculation among some market participants that the Fed might reduce the anticipated number of cuts to two due to inflation proving stickier than anticipated.

However, the Fed’s outlook for 2025 indicated a moderation in the pace of rate cuts, with the median Fed Funds Rate forecasted to reach 3.9%, compared to the 3.6% projected in the December SEP.

The Fed significantly upgraded its GDP forecast for 2024 to 2.1%, up from 1.4% in December, which many interpreted as signaling a “soft landing.”

Regarding inflation, the Fed revised its forecast for the Core Personal Consumption Expenditure (PCE) Price Index upwards to 2.6% for 2024, compared to 2.4% projected in December.

During the post-meeting press conference, Federal Reserve Chairman Jerome Powell attempted to downplay concerns over recent high inflation readings, suggesting that only two months’ worth of data were insufficient to sway the Fed from its current course.

The overall market interpretation of the Fed’s stance was seen as dovish, prompting a sell-off of the US Dollar from its previously overbought levels. Consequently, the EUR/USD pair, which gauges the purchasing power of a single Euro (EUR) against the US Dollar (USD), rebounded into familiar trading territory.

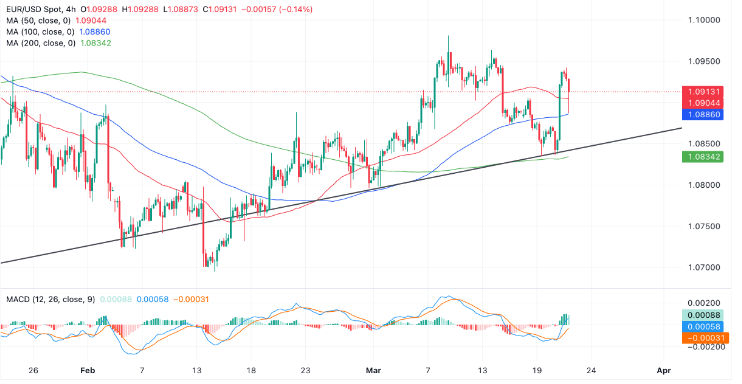

Technical Analysis: EUR/USD returns to the 1.0900s

EUR/USD reversed on a dime at around the level of the 200-day Simple Moving Average (SMA) in the 1.0830s and surged higher after the Fed meeting. On Thursday, however, it pared gains following weak manufacturing data from the Eurozone.

It is now trading in the lower 1.0900s and seems to be trading in a range, with no real bias one way or another.

The ongoing upward momentum following Wednesday’s lows remains evident. Should prices continue to rise, they are likely to encounter resistance around the March 13 highs of 1.0964. Breaking above this level would bring the March 8 highs for the month into consideration at 1.0981, signaling a shift towards a bullish outlook.

Conversely, the upward movement could lose steam, leading to a potential decline back towards the 50-day Simple Moving Average (SMA) in the 1.0840s, followed by a retracement towards the 200-day SMA around the 1.0830s.