- The EUR/USD pair has dipped into the 1.0800s, nearing a crucial threshold for its short-term trajectory.

- A continuation of this weakness may sway the near-term outlook in favor of bearish sentiment.

- To conclude the week, key events include the release of the Empire State Manufacturing Index, Michigan Sentiment data, US Industrial Production figures, and insights from ECB’s Nagel.

On the final day of the week, EUR/USD is trading in the 1.0800s, having descended from its previous range in the 1.0900s. This shift appears to be influenced by a combination of robust US macroeconomic data and comments from ECB’s chief economist, Philip Lane, dampening early rate-cut expectations.

Friday’s US data continued to bolster Thursday’s positive momentum. Industrial Production for February surpassed expectations, registering a growth of 0.1% against forecasts of stagnant growth. Additionally, the Export Price Index surged by 0.8%, well above the anticipated 0.2%, further reinforcing the inflationary narrative. UoM 5-year Consumer Inflation Expectations remained unchanged at 2.9%, matching previous figures.

However, not all US data painted a rosy picture. The Michigan Consumer Sentiment Index for March slightly missed expectations, coming in at 76.5 compared to the previous figure of 76.9. Similarly, the NY Empire State Manufacturing Index fell short of forecasts, recording a negative 20.9 against an expected negative 7, following the previous negative 2.4.

Overall, the data has tempered expectations, leaning towards the Federal Reserve (Fed) maintaining higher interest rates for an extended period. This sentiment weighs negatively on EUR/USD but bolsters the US Dollar (USD) as higher interest rates attract increased foreign capital inflows.

EUR/USD: Talking heads at ECB cluster around summer

A multitude of European Central Bank (ECB) policymakers have recently made public appearances to express their perspectives on the timing of potential interest rate cuts.

The official stance, articulated by Christine Lagarde during the press conference following the March ECB meeting, indicated that the Governing Council would assess interest rates in June.

However, after the meeting, Governor of the Bank of France, Francois Villeroy de Galhau, ignited market speculation by suggesting the possibility of an interest-rate cut as early as April. His remarks hinted at the emergence of two factions within the ECB, one advocating for a rate cut in spring and the other in summer.

On Wednesday, Governor of the Bank of Austria and ECB Governing Council member, Robert Holzmann, aligned with the June camp.

Early Thursday, ECB Governing Council member Yannis Stournaras appeared to support the argument for a spring rate cut, expressing skepticism towards the notion that the ECB must wait for the Federal Reserve to act. Stournaras also suggested that four rate cuts in 2024 could be justifiable.

Also on Thursday, ECB Governing Council member Klaas Knot voiced his belief that the ECB would commence interest rate cuts in June.

Vice-President of the ECB, Luis de Guindos, remarked in Barcelona on Thursday that “The ECB should have sufficient information in June to begin making decisions about monetary policy,” as reported by Bloomberg News.

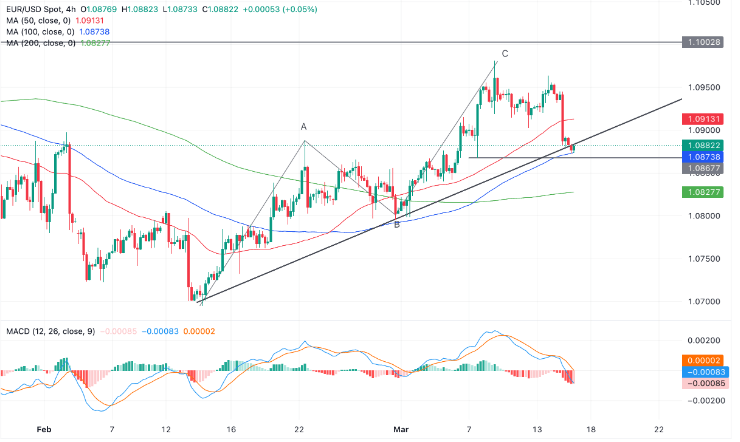

Technical Analysis: EUR/USD reaches critical trend-determination level

EUR/USD continues correcting back, falling into the 1.0800s, after peaking at 1.0981 on March 8.

After Thursday’s sell-off, the correction is now so deep it brings into question the sustainability of the hitherto dominant short-term uptrend.

Bears have driven the price down to just a few pips above the critical 1.0867 level, previously identified as the make-or-break point for the trend. A breach below this level could signal a potential reversal of the uptrend, shifting the balance of probabilities.

If such a breakdown occurs, it is likely to lead to a continuation downwards towards 1.0795, marking the low of the B leg within the prior ABC Measured Move pattern observed throughout February and early March.

Conversely, if the level manages to hold, the short-term uptrend may resume. Confirmation of this would be signaled by a higher high and a further extension of the uptrend, particularly if there is a break above the 1.0981 highs.

Nevertheless, significant resistance is anticipated at the psychological level of 1.1000, where a fierce battle between bulls and bears is expected to unfold. A decisive break above 1.1000, characterized by either a long green candle piercing clearly above the level and closing near its high, or three consecutive green bars surpassing the level, could pave the way for further gains towards the key resistance level at 1.1139, representing the December 2023 high.