- Euro losses a step vs US Dollar, eyes on Fed decision.

- US housing gains, Building Permits, and Housing Starts rise.

- Germany’s ZEW and EU surveys beat expectations, uplifting investor sentiment.

The Euro continues to face pressure against the US Dollar as traders await the Federal Open Market Committee (FOMC) monetary policy decision scheduled for Wednesday. Consequently, the EUR/USD pair is currently trading at 1.0859, experiencing a 0.12% decline.

EUR/USD dips amid central bank movement, positive US housing data

In Tuesday’s trading session, two significant central bank decisions unfolded. The Bank of Japan (BOJ) opted to step away from negative interest rates but delivered a dovish rate hike, leading to a weakening of the Japanese Yen (JPY) against most G8 currencies. Meanwhile, the Reserve Bank of Australia (RBA) maintained interest rates unchanged at 4.35%, with considerations for a rate hike if inflation picks up pace.

Elsewhere, Wall Street saw notable gains as global bond yields experienced a decline. Noteworthy data from the US housing sector revealed that Building Permits for February increased by 1.9% month-on-month, rising from 1.489 million to 1.496 million. Additionally, Housing Starts for the same period surpassed expectations with a 10.7% increase.

At the same time, the yield on the US 10-year Treasury bond retreated by two basis points, falling to 4.034%. The US Dollar Index (DXY), which measures the dollar against a basket of other currencies, showed a 0.23% gain, reaching 103.82.

In the Eurozone (EU), Germany released the March ZEW Survey, indicating an improvement with a reading of 31.7 for the country and a surge to 33.5 for the EU, surpassing estimates.

EUR/USD Price Analysis:

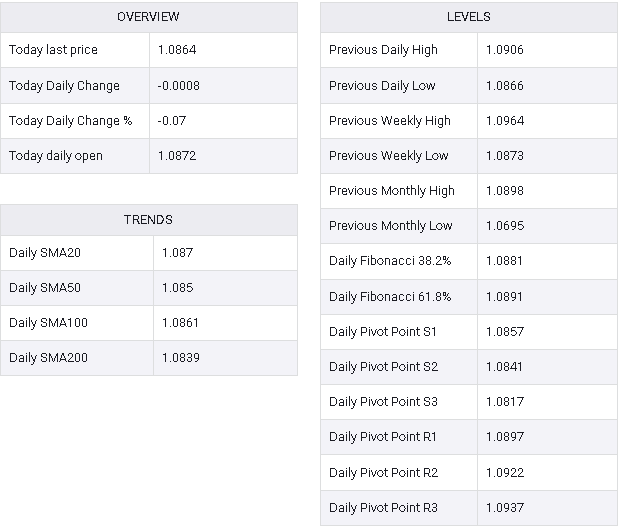

Technical Perspective Analyzing the daily chart of EUR/USD suggests a neutral to downward bias for the pair, although dynamic support levels such as the 200, 100, and 50-day moving averages (DMAs) have limited the Euro’s losses, potentially paving the way for a recovery. Should buyers push the exchange rate above 1.0900, it could expose the March 13 high at 1.0964, followed by the year-to-date (YTD) high at 1.0981. Conversely, sellers aiming for downside momentum would need to breach the 200-DMA at 1.0838, potentially targeting the 1.0800 level.

EUR/USD