- GBP/JPY rises buoyed by uncertainty over BoJ’s interest rate stance, marking a weekly gain.

- Recovery from near the 50-day DMA suggests bullish momentum, with eyes on the 190.00 resistance mark.

- A drop below the Kijun Sen could signal a correction phase, with significant support at the March 11 low.

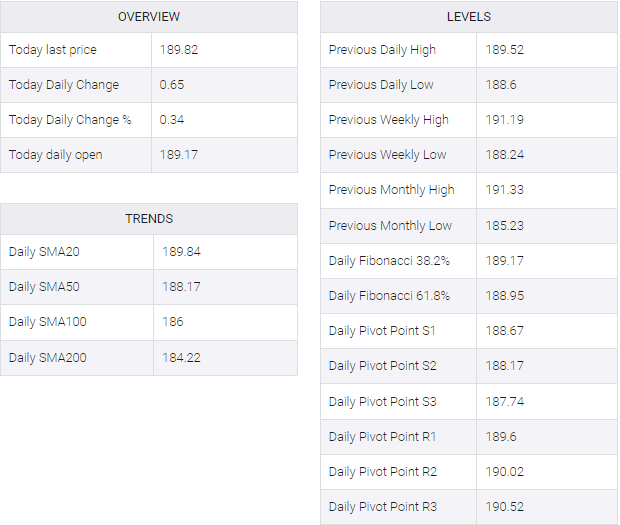

The Pound Sterling continued its upward trajectory against the Japanese Yen, poised to conclude the week with gains. Currently, the GBP/JPY pair trades at 189.72, representing a 0.34% increase. The Bank of Japan (BoJ) contributed to market uncertainty as officials delivered conflicting messages throughout the week, leading investors to sell the Yen amidst growing speculation that the BoJ would refrain from raising rates.

GBPJPY Price Analysis: Technical outlook

The cross-pair has rebounded after testing the 50-day moving average (DMA) at 187.84, halting the decline in GBP/JPY amidst speculation about the BoJ’s potential shift away from negative interest rates. Subsequently, a ‘bullish harami’ candle pattern emerged, driving prices higher. Presently, the next resistance level stands at 190.00. Surpassing this barrier would expose the March 4 high of 191.18, followed by the year-to-date high of 191.32.

In a bearish scenario, sellers would need to push the price below the Kijun Sen at 189.58, followed by the Senkou Span A at 189.64. While this suggests an ongoing correction, a drop below the March 11 low of 187.96 could potentially trigger a deeper pullback.

GBPJPY Price Action – Daily Chart

GBP/JPY