- GBP/JPY down, near 188.04, on BoJ policy change rumors.

- Sterling’s future uncertain without UK data; employment figures crucial.

- Technical signs suggest more drops; key support levels watched.

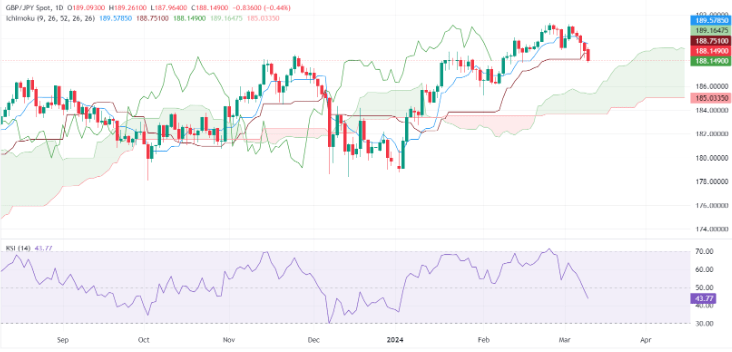

In the mid-North American session, the GBP/JPY is holding onto the 188.00 level, registering a decline of 0.51%. The pair is currently trading at 188.04, retracing from the earlier daily peak of 189.17.

Speculation surrounding a potential discontinuation of negative interest rates by the Bank of Japan (BoJ) prompted a upward movement in the Yen against most G7 currencies. Meanwhile, the British Pound remains under pressure in the absence of significant economic data from the UK. However, the upcoming employment figures on Tuesday could potentially offer support to Cable.

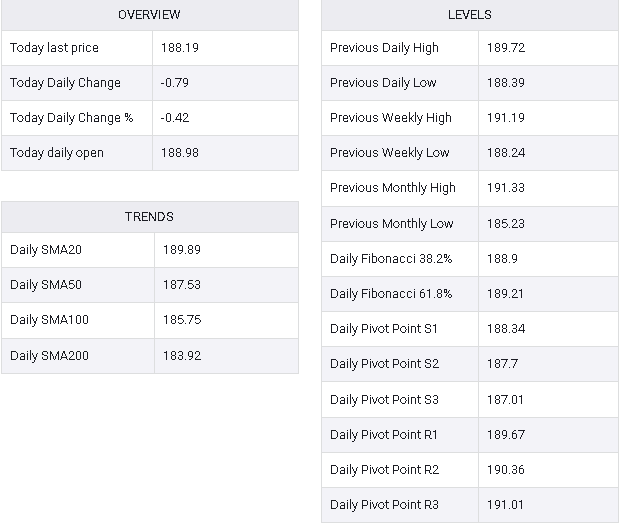

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY experienced a further decline below the Tenkan and Kijun-Sen levels, leading to a drop to a four-week low of 187.95. However, buyers intervened, prompting a rebound in the exchange rate, which has now stabilized around the 188.00 level. The potential for an upward movement could materialize with a daily close above this level.

Conversely, if the downtrend persists, the pair may extend its decline towards the 50-day moving average (DMA) at 187.64, followed by the 187.00 mark. A breach of these levels could pave the way for additional support at the 100-DMA, situated at 185.77.

GBP/JPY Price Action – Daily Chart

GBP/JPY