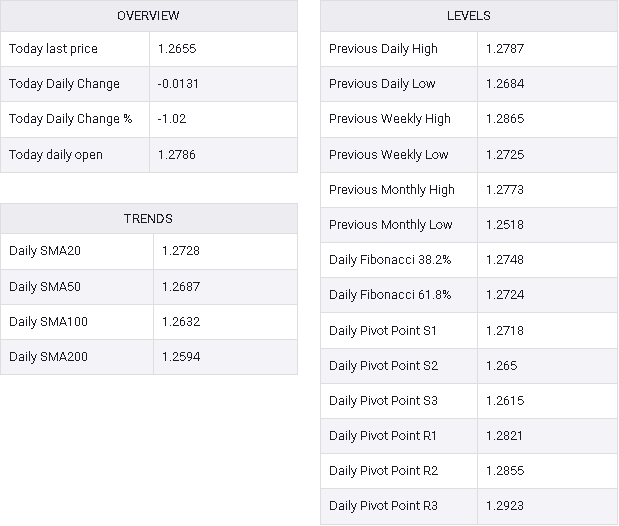

- GBP/USD falls to 1.2659 after BoE’s dovish stance.

- BoE holds Bank Rate, hints at future cuts amid shifting views.

- UK inflation drop fuels June BoE rate cut bets.

- US Dollar bolstered by lower unemployment claims and economic strength.

The British Pound experiences a significant decline against the US Dollar, marking a fresh two-week low in response to recent monetary policy decisions by major central banks. Thursday saw the Bank of England (BoE) adopt a dovish stance, prompting a reversal in price dynamics. Currently, the GBP/USD pair is trading at 1.2659, reflecting a decrease of 0.97% from previous levels.

Sterling erases Wednesday’s gains on BoE’s dovish pivot

The Bank of England (BoE) opted to maintain the Bank Rate at 5.25%, reflecting a split vote of 8-1 among policymakers, with no officials anticipating a rate hike. Notably, one dissenter voted in favor of a rate cut. This marks a notable shift from the previous meeting where policymakers voted 6-3, with two members expecting a rate hike. The adjustment in stance among policymakers suggests a growing consensus within the BoE that the current rate level is effectively mitigating inflationary pressures.

Recent inflation reports in the UK indicate a decline from 4% to 3.4%. Subsequent to the BoE’s decision, money markets are now pricing in a 75% probability of a rate cut in June, up from 65% earlier in the day.

Meanwhile, the US Dollar regained some lost ground following the Federal Open Market Committee (FOMC) policy decision on Wednesday. The FOMC opted to maintain rates unchanged and did not revise its expectations for rate cuts in 2024, despite consecutive high inflation reports in the US. Federal Reserve (Fed) Chair Jerome Powell acknowledged the challenges ahead in steering inflation towards the Fed’s 2% target, describing the journey as potentially turbulent.

In terms of US economic indicators, unemployment claims for the last week declined from 212K to 210K, surpassing the estimated 215K. Additional data revealed mixed final readings for S&P Global Flash PMI in March, although manufacturing activity demonstrated improvement. Furthermore, Existing Home Sales surged from 4 million to 4.38 million, representing a notable increase of 9.5%.

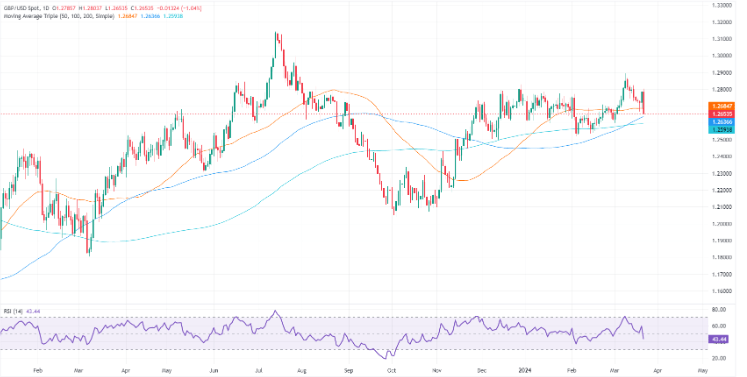

GBP/USD Price Analysis: Technical outlook

Considering the fundamental landscape, the GBP/USD continued its downward trajectory, marking a significant ‘bearish engulfing’ candle pattern, heightening the likelihood of further declines. The Relative Strength Index (RSI) deepens its descent into bearish territory, while attention shifts to the pivotal 200-day moving average positioned at 1.2592. A breach of the psychological level at 1.2600, coupled with surpassing the 200-DMA, may open the path towards testing the support at 1.2500. Conversely, should buyers manage to reclaim ground above 1.2700, a period of consolidation cou

GBP/USD