- GBP/USD experiences a decline in response to robust US inflation data and retail sales figures, which bolster confidence in a less dovish outlook from the Federal Reserve. The US Dollar demonstrates resilience further aided by signs of recovery in industrial production.

- Meanwhile, market focus shifts to the UK labor market report, which influences speculation regarding potential rate cuts by the Bank of England. All eyes are on the upcoming June monetary policy meeting.

- Anticipation mounts for next week’s meetings of both the Federal Reserve and the Bank of England, with inflation data expected to play a pivotal role in shaping the direction of GBP/USD.

The Pound Sterling is set to finish the week with losses, yet extended its downtrend for two straight days after piercing the 1.2800 figure. The GBP/USD exchanges hands at 1.2731, post losses of 0.16%.

GBP/USD retreats below 1.2800, exposing critical support levels after hot US inflation

The Greenback maintains its strength as traders adjust their expectations towards a less dovish stance from the Federal Reserve. The latest data from the US Department of Labor revealed February’s consumer and producer inflation figures, indicating persistent elevated prices hovering around the 3% mark. Despite a solid Retail Sales report showing improvement compared to the previous month, it fell short of exceeding expectations.

Today’s economic schedule in the US highlighted a rebound in Industrial Production for February, breaking a two-month streak of decline. Manufacturing output rose by 0.1% month-on-month, surpassing the consensus forecast. However, the preliminary reading of the University of Michigan Consumer Sentiment came in below estimates at 76.5, indicating subdued confidence among Americans. Expectations for inflation remain at 3% for the next 12 months and 2.9% over the next five years.

On the other side of the Atlantic, a softer labor market report weighed on the Cable (GBP/USD) as the unemployment rate edged higher and Average Earnings excluding Bonuses dipped from 6.2% to 6.1%, indicating a slowdown in wage inflation. This data spurred increased speculation about a potential rate cut by the Bank of England (BoE) in June.

As traders brace for next week’s monetary policy decisions from both the Federal Reserve and the Bank of England, the consensus expects both institutions to maintain unchanged interest rates. However, any dovish signals could prompt reactions in financial markets. Additionally, attention will be on the release of inflation figures in the UK.

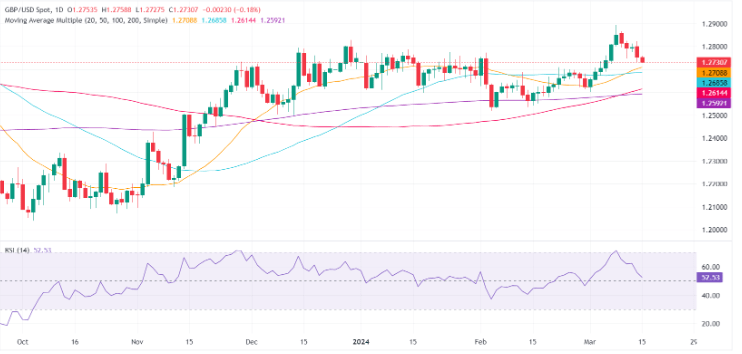

GBP/USD Price Analysis: Technical outlook

Buyers of GBP/USD struggled to maintain their hold above 1.2800, leading to a decline below the recent cycle high of 1.2827 and further sliding below the 1.2800 level. Consequently, this exposed significant support levels, notably the 50-day moving average (DMA) situated at 1.2685, followed by the preceding cycle low observed on March 1 at 1.2599. Once these levels are breached, the combined influence of the 100 and 200-DMAs around 1.2589/1.2601 would come into focus.