- Mexican Peso stays on the defensive after Banxico meeting.

- Banxico’s rate cut marks the beginning of an easing cycle, though decision was not unanimous.

- Banxico commits to monitoring inflation closely, aiming for a 3% target by Q2 2025 amidst ongoing restrictive policies.

- Mexico’s retail sales data indicate cautious consumer spending, justifying Banxico’s decision for a rate cut.

The Mexican Peso (MXN) persists in its downward trend against the US Dollar (USD), maintaining stability within familiar ranges subsequent to the Bank of Mexico’s (Banxico) recent decision to implement its first rate cut since mid-2021. The move by Banxico wasn’t unanimous, with Deputy Governor Irene Espinosa advocating to maintain rates unchanged. Presently, the USD/MXN pair trades at 16.74, reflecting a 0.40% increase.

Commencing its easing cycle on Thursday, Mexico’s Central Bank reduced the main reference rate from 11.25% to 11.00% in a split decision of 4 to 1. Banxico’s Governing Council emphasized its commitment to monitoring inflationary pressures, indicating that future policy adjustments would hinge on forthcoming data in subsequent monetary policy meetings.

Banxico underscored that its policy stance remains restrictive, affirming its belief in the continuation of the disinflation process, with an expectation to achieve its 3% inflation target by the second quarter of 2025.

Meanwhile, market participants continued to digest the recent monetary policy stance of the Federal Reserve, which maintained unchanged rates and retained projections for three 25 basis points rate cuts by year-end. Despite an upward revision of the federal funds rate (FFR) level to 3.9%, the Fed’s decision was interpreted as dovish.

Daily digest market movers: Mexican Peso weakens as reduction of rate differentials looms

- Mexico experienced a decline in Retail Sales of -0.6% month-on-month (MoM) in January, falling short of the anticipated 0.4% expansion, albeit an improvement from December’s figures. However, on a yearly basis, Retail Sales plummeted from -0.2% to -0.8%, significantly below the projected 1.2% expansion.

- Other economic indicators from Mexico released during the week include a 0.3% quarter-on-quarter (QoQ) increase in Aggregate Demand in the fourth quarter, up from 0% previously. However, on an annual basis, Aggregate Demand decelerated from 2.7% to 2.6%. Additionally, Private Spending slowed from 1.2% to 0.9% on a quarterly basis but improved from 4.3% to 5.1% on a yearly basis.

- The economic slowdown in Mexico is cited as a key factor driving Banxico’s consideration of its first rate cut. The central bank anticipates the economy to grow by 2.8% year-on-year (YoY) in 2024, down from the previous estimate of 3%, while maintaining its prior projection of 1.5% growth for 2025.

- In the United States, Initial Jobless Claims for the week ending March 16 increased by 210K, below estimates of 215K and the prior week’s figures. S&P Global PMI figures presented a mixed picture, with Services and Composite PMI readings cooling but remaining in expansionary territory. However, the Manufacturing PMI surpassed estimates, rising to 52.5 from the previous reading of 52.2.

- Furthermore, Existing Home Sales surged by 9.5% from 4 million to 4.38 million.

- The latest inflation data in the United States influenced investors to adjust their expectations for a less dovish stance. Money market futures now anticipate the Federal Funds Rate (FFR) to reach 4.71% by the end of the year, more closely aligning with the Fed’s projections. Analysts estimate that the Fed will likely maintain its FFR level until June or later.

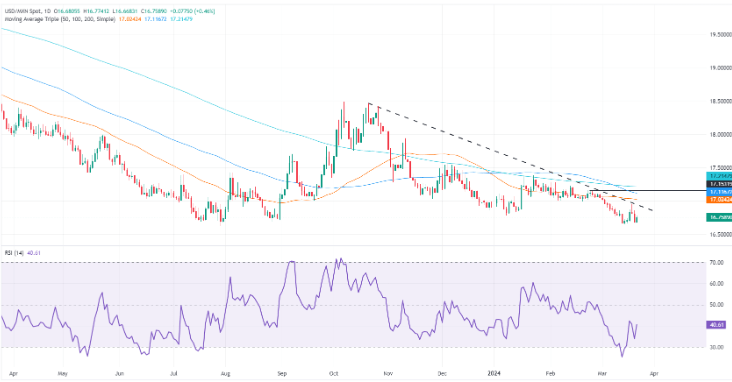

Technical analysis: Mexican Peso treads water as USD/MXN accelerates to 16.80

As noted on Wednesday, the USD/MXN pair maintains a neutral to downward bias, as buyers initially pushed the exchange rate to a weekly peak of 16.94 before retracing below 16.80. However, the impending decision by the Mexican Central Bank could potentially alter this trajectory, particularly if a quarter percentage rate cut is implemented. Such a move could bolster the exotic pair and facilitate a breakthrough of key resistance levels.

The primary resistance level to watch would be the March 19 cycle high at 16.94, followed by the significant psychological barrier at 17.00. Subsequently, attention would shift to a cluster of dynamic supply zones, starting with the 50-day Simple Moving Average (SMA) at 17.01, followed by the 100-day SMA at 17.12, and finally, the 200-day SMA at 17.20.

On the contrary, sellers would need to drive the exchange rate below the current year-to-date low of 16.64 to pose a challenge to last year’s low of 16.62.

USD/MXN Price Action – Daily Chart