- Natural Gas prices are nosediving over 1.50% ahead of the US opening bell.

- Summer gas contracts are trading substantially lower, pointing to even lower than expected demand out of Europe.

- The US Dollar Index trades around 104.00 ahead of Super Tuesday and US PMI numbers.

Natural Gas (XNG/USD) takes a sharp downturn, heading into negative territory this Tuesday. The previously optimistic run comes to an abrupt halt, marked by traders offloading near-term contracts, while contracts with later expiration dates experience even more pronounced selling pressure. The primary cause behind this shift is the lack of European demand in the market. It appears that the demand to replenish gas stockpiles is turning out to be even more underwhelming than initially anticipated.

In the midst of this, the US Dollar (USD) is preparing for a week filled with significant events. The first in line is the much-anticipated Super Tuesday, a pivotal day in the presidential primary election. Following closely is another major event on Thursday – the European Central Bank (ECB) monetary policy decision, which serves as a litmus test for the upcoming US Federal Reserve meeting on March 20. Leading up to the Super Tuesday Primaries results, traders will closely monitor the S&P Global Services Purchasing Managers Index (PMI) and the data release from the Institute for Supply Management (ISM).

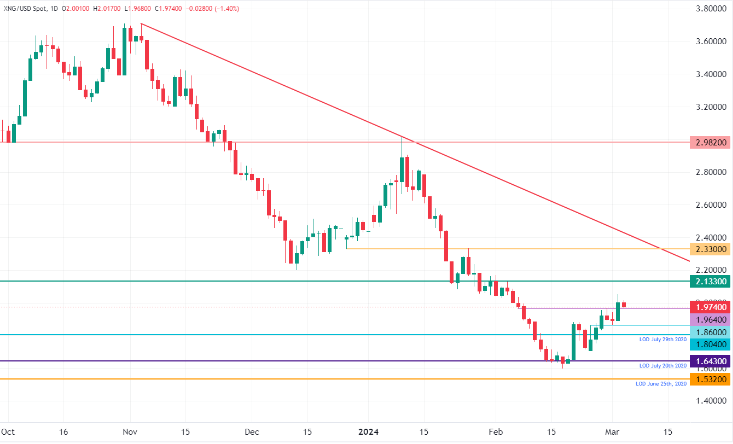

Natural Gas is trading at $1.97 per MMBtu at the time of writing.

Natural Gas market movers: European tepid demand puts bulls under pressure

- The near-term selling pressure is taking over from the longer-term speculation, with firm selling pressure ahead of the US opening bell.

- According to a weekly Bloomberg report, global weekly LNG supply fell by 13% for the week of February 26 against the previous week.

- Temperatures are set to fall again in China and Europe, heading back below 10 degrees Celsius, which is below the 10-year average.

- European demand is not picking up, forcing several gas cargoes to stay at sea.

- Roughly 3 million metric tons have been afloat at sea for more than 20 days, a very high number compared to normal standards.

- Russia is facing headwinds from fresh US sanctions issued two weeks ago.

- Russia had ordered icebreaker vessels for its Arctic LNG 2 exports at a South Korean shipbuilder.

- However, under the new sanctions, Hanwha Ocean (the South Korean shipbuilder) is forbidden to sell to Russia, which means Russia is unable to open its Arctic installation for production and exports.

Natural Gas Technical Analysis: A rally comes not that easily

Natural Gas prices are experiencing increased upward pressure as both Qatar and the US deliver less than 13% of the normal weekly volume. These substantial drawdowns in supply are rapidly influencing market dynamics, causing Gas prices to surge for the second consecutive day, surpassing the $2 level once again. However, the prevailing selling pressure, particularly in the summer contracts, is extending into the near-term contracts, erasing the earlier tailwind for Natural Gas.

Natural Gas is making a move beyond the $1.99-$2.00 range – a level that witnessed an accelerated decline back in early February when broken on the downside. Beyond this, attention turns to the green line at $2.13, marked by the triple bottoms from 2023. In the event of a sudden pickup in demand, $2.40 could become a significant target.

To the downside, watch out for targets at $1.64 and $1.53 (the low of 2020). Prior to reaching those levels, the recently established pivotal points at $1.86 and $1.80 are expected to offer support, potentially slowing down any downward movements.