- Natural Gas price is making an effort to maintain its position above $2.00.

- Gas exports from Norway are experiencing an uptick once more following unplanned maintenance.

- The US Dollar Index is currently trading below 104.00, although this level remains within reach.

Natural Gas (XNG/USD) is resilient against selling pressure, successfully holding the $2.00 level on Wednesday, building on the gains from Tuesday. Despite the recent rally, Gas bulls face a challenging outlook as concerns loom over the commodity. Political efforts are underway to negotiate a ceasefire ahead of Ramadan in Gaza, impacting the flow of Norwegian Gas to the UK and Europe, recovering after unforeseen outages in recent weeks.

Simultaneously, the US Dollar (USD) is experiencing prepositioning ahead of three significant days. On Wednesday, US Federal Reserve Chairman Jerome Powell is set to deliver his semi-annual testimony before Congress. Thursday brings insights from European Central Bank President Christine Lagarde after the bank’s latest rate decision, followed by the release of the US Employment Report on Friday.

Natural Gas is trading at $2.04 per MMBtu at the time of writing.

Natural Gas market movers: Risk On helps Natural Gas

- Europe is witnessing the highest Gas storage levels in years as the heating season concludes, resulting in reduced demand to replenish reserves before the next heating season.

- Notably, Norwegian Gas flows to the UK and Northwest Europe are increasing after addressing unplanned maintenance issues.

- Simultaneously, heightened demand emerges from Asia, driven by a rally in Coal prices and the cost-effectiveness of Gas for electricity production.

- In a significant development, Ukraine Energy Minister German Galushchenko announced on Tuesday that expiring Russian Gas contracts for deliveries will not be extended, contributing to a further reduction in Russian gas inflows into Europe.

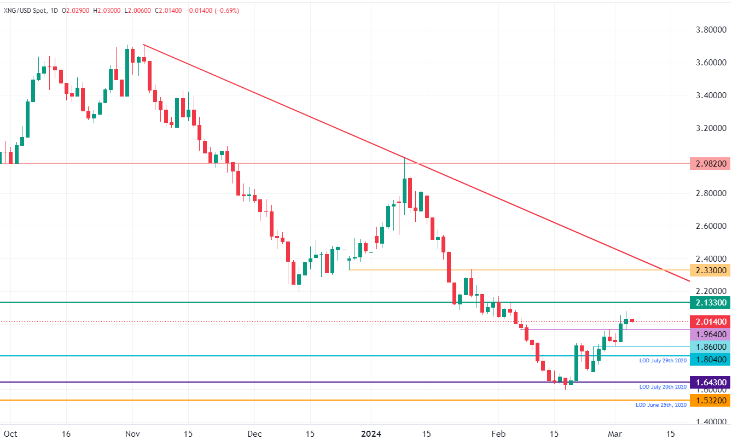

Natural Gas Technical Analysis: Substantially nothing changed

Natural Gas prices reacted swiftly to supply disruptions in the US and Qatar. However, market sentiment is now turning bearish as Europe signals reduced Gas demand over the summer, preparing for the upcoming heating season. This suggests that prices may remain stable or even decline.

Breaking the $1.99-$2.00 support level, Natural Gas eyes the $2.13 level, marked by triple bottoms from 2023. Further upside potential exists if there’s a sudden surge in demand, with $2.40 as a potential target.

On the downside, key levels to watch include $1.64 and $1.53 (the 2020 low). Prior to reaching these levels, recently-established pivotal points at $1.86 and $1.80 are expected to offer support and impede significant downward movements.