- Following the release of the latest US inflation figures for February, the New Zealand Dollar has weakened against the US Dollar.

- The data suggests persistent inflationary pressures, potentially leading the Federal Reserve to maintain elevated interest rates to address the situation.

- As a result, the NZD/USD pair is retreating towards its range lows in the 0.6080s.

The New Zealand Dollar is trading lower against the US Dollar on Tuesday following the release of US Consumer Price Index (CPI) data for February. The data indicates that inflationary pressures persist in the American economy, which may prompt the Federal Reserve (Fed) to maintain higher interest rates for an extended period to address the situation. This tendency towards relatively higher interest rates is typically favorable for the US Dollar, attracting increased foreign capital inflows.

However, the influence of Gasoline and Energy prices, which have been significant contributors to the elevated inflation, may limit the upside potential for the US Dollar. These factors are viewed as less entrenched pressures and are subject to fluctuations in global commodity prices.

New Zealand Dollar declines vs US Dollar after US CPI beat

On Tuesday, the New Zealand Dollar continued its downward trajectory against the US Dollar, following the release of both headline and core US Consumer Price Index (CPI) data for February, which surpassed estimates, as reported by the Bureau of Labor Statistics (BLS).

The core US CPI, excluding Food and Energy prices, registered a year-on-year increase of 3.8%, exceeding analysts’ expectations of a 3.7% rise. Although this figure was lower than January’s 3.9%, it indicates that inflation remains elevated, albeit not decreasing as rapidly as anticipated.

Month-on-month, core CPI surged by 0.4%, surpassing the forecast of 0.3% and mirroring the previous month’s 0.4% increase.

Meanwhile, the broader headline CPI figure unexpectedly rose by 3.2% year-on-year, surpassing the forecasted 3.1% and exceeding January’s 3.1% as well. On a monthly basis, headline CPI increased by 0.4%, aligning with estimates and exceeding January’s 0.3% rise.

Following the CPI release, the CME FedWatch Tool, which gauges market-based expectations of Federal Reserve policy actions, revealed a decline in the probability of a rate cut in March to 1%, down from 3% prior to the data. Additionally, the likelihood of one or more 25 basis point cuts by May decreased slightly to 16.8%, while the probability of rate cuts by June decreased to 69.7% from 71.4% prior to the data release.

Technical Analysis: New Zealand Dollar continues falling inside range

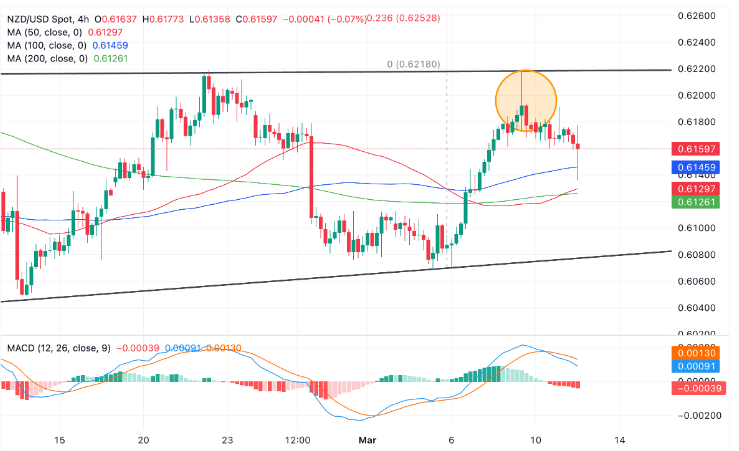

The downward momentum persists for the NZD/USD pair following its peak in the 0.6220s range on Friday. At that level, a bearish Shooting Star Japanese candlestick pattern emerged on the 4-hour chart, signaling a potential reversal in the pair’s direction (circled).

The combination of the Shooting Star formation, the range high, and the subsequent downward movement indicates a shift in the short-term trend, with the pair now descending within its range towards the lower end around 0.6080-90.

The downward movement was further confirmed by the Moving Average Convergence/Divergence (MACD) indicator crossing below its signal line while in positive territory, supporting the bearish outlook.

A breakout above the range high and the high of the Shooting Star would be required to signal a bullish market sentiment. Such a breakout could target 0.6309, representing the 61.8% Fibonacci extrapolation of the range’s height from the breakout point upwards.