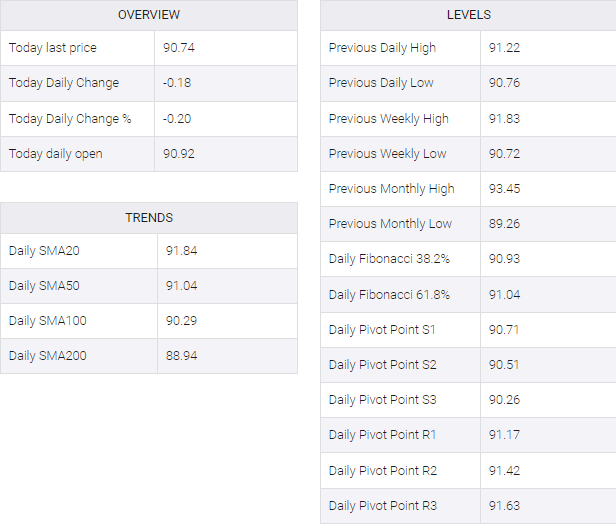

- On the daily chart, sellers remain in control despite the improvement of the RSI and MACD.

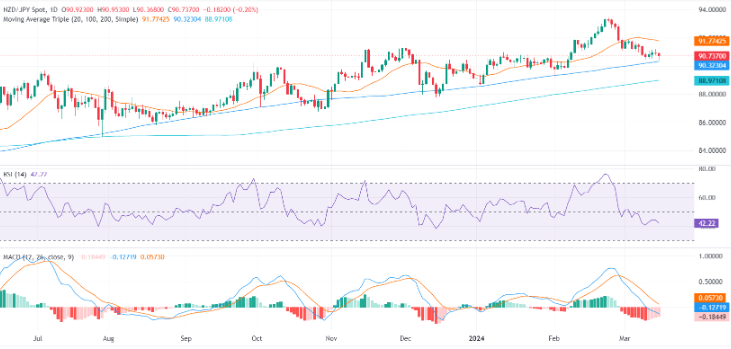

- While the daily chart emits bearish signals, the hourly indicators provide a more balanced picture, showcasing an equilibrium between buyers and sellers.

- The cross saw a recovery during the American session and managed to clear daily losses.

In Friday’s trading session, NZD/JPY is priced at 90.70, marking a slight decline of 0.22% from its low of 90.35. While the pair remains positioned above the crucial 100 and 200-day Simple Moving Averages (SMAs), suggesting potential bullish trends in the broader perspective, the shorter-term technical analysis leans towards bearish sentiments as the pair trades below the 20-day average.

On the daily chart, the Relative Strength Index (RSI) for NZD/JPY has consistently remained in negative territory, indicating a dominance of sellers in the market. Similarly, the Moving Average Convergence Divergence (MACD) presents a subdued outlook, with its histogram displaying flat red bars, reflecting a lack of positive momentum and buying strength.

NZD/JPY daily chart

Switching to the hourly chart, the RSI recovered towards 50, the neutral level, suggesting a balance between buyers and sellers. On the other hand, the MACD histogram displays flat green bars, indicating a steady positive momentum.

NZD/JPY hourly chart

In summary, the broader daily analysis suggests a predominantly bearish outlook, as evidenced by the dominance of sellers indicated by the RSI and MACD, coupled with the pair’s position below the 20-day SMA. However, the hourly chart presents a somewhat mixed perspective, indicating a more balanced interplay between buyers and sellers. Despite the immediate bearish sentiment, the pair’s position above the 100 and 200-day SMAs suggests that bulls may still have an opportunity to regain control.

NZD/JPY