- NZD/USD is experiencing modest increases as the US Dollar weakens, notwithstanding reduced expectations of a Fed rate cut in June.

- The Reserve Bank of New Zealand (RBNZ) anticipates a 0.8% increase in inflation during the first quarter of the current year.

- Market participants are eagerly awaiting the release of US Retail Sales data for updated direction.

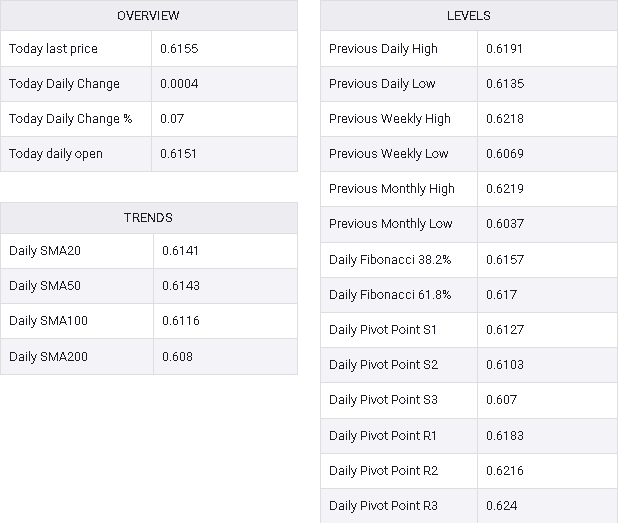

In Wednesday’s early American session, the NZD/USD pair shows a marginal increase of 0.08%, reaching 0.6160. The Kiwi asset appears to be trading sideways as investor attention shifts towards the upcoming release of United States Retail Sales data for February, scheduled for Thursday. This data will offer insights into the strength of household spending, which directly impacts consumer price inflation.

Despite easing expectations for the Federal Reserve (Fed) to implement interest rate cuts in the June policy meeting, the US Dollar has edged down to 102.80. According to the CME Fedwatch tool, traders now perceive a 65% probability of the Fed announcing rate cuts in June, down from over 72% before the release of February’s inflation report.

Conversely, the easing inflation expectations in New Zealand are anticipated to provide some relief for households. Recent forecasts from the Reserve Bank of New Zealand (RBNZ) indicate that consumer prices are projected to increase by 0.8% in the quarter ending in March. Additionally, annual inflation is expected to decline to 4.2% from 4.7% in the last quarter of 2023. Given the significant current price pressures, the RBNZ is likely to maintain higher interest rates for an extended period, as they significantly surpass the desired rate of 2%.

The NZD/USD pair has been oscillating within a range of 0.6037-0.6218 over the past two months on a four-hour timeframe, suggesting indecision among market participants.

The 14-period Relative Strength Index (RSI) is trading within the 40.00-60.00 range, indicating a notable contraction in volatility.

Looking ahead, a downward move below the low of February 13 near 0.6050 could expose the pair to psychological support at 0.6000, followed by the high from November 9 at 0.5956.

Alternatively, an upward move would materialize if the pair breaks above the resistance level of 0.6200, potentially propelling it towards the high of February 22 at 0.6220, and subsequently the high from January 11 at 0.6260.

NZD/USD four-hour chart

NZD/USD