- Following the US Jobs Report, WTI Oil experienced a neutral performance, leveling off in the aftermath.

- Traders in the oil market are optimistic about an upswing in demand, attributing this outlook to anticipated economic growth driven by interest-rate cuts.

- Concurrently, the US Dollar Index dipped below the 103.00 level, settling in the lower-102.00s after the release of the Nonfarm Payrolls (NFP) data.

Despite initial indications of heading towards the $80 level, oil prices have stabilized, showing little change. Investor sentiment appears optimistic about an enhanced demand outlook, triggered by dovish remarks from US Federal Reserve Chairman Jerome Powell. Powell’s statements during a two-day congressional hearing indicated the Fed’s readiness to implement interest rate cuts, potentially stimulating economic growth and consequently increasing demand for oil.

In response to Powell’s comments, the US Dollar Index (DXY), measuring the Greenback against a basket of foreign currencies, experienced a significant decline on Thursday. As the US Dollar weakened, oil prices found room for potential ascent, given the historical correlation between the Greenback and commodity prices. Despite the subdued revisions in Nonfarm Payrolls and a mere 0.1% increase in Average Hourly Wages, suggesting reduced demand and a hesitancy to invest in attracting qualified employees, crude oil (WTI) is currently trading at $78.15 per barrel, while Brent Oil is priced at $82.35 per barrel at the time of writing.

Oil news and market movers: NFP set the stage for June

- Oil traders resume bullish positions, anticipating economic growth spurred by interest-rate cuts in Europe and the US.

- Increasing demand is observed in Asia, particularly from India and China, as industrial and travel activities pick up, driving oil consumption.

- Geopolitical tensions persist with failed ceasefire talks in Gaza and ongoing reports of Houthi attacks in the Red Sea.

- Baker Hughes Oil Rig Count, scheduled for release this Friday at 18:00 GMT, follows the previous count of 506 rigs.

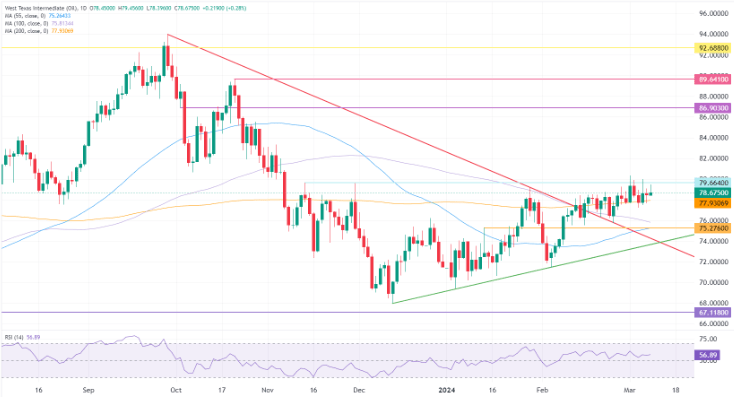

Oil Technical Analysis: NFP confirms US economy rolling over and Fed cuts needed soon

Oil prices are now entering a scenario reminiscent of the dynamics observed in 2013, a period marked by a notably weaker US Dollar that facilitated a surge in oil prices towards the $100 mark. The current landscape, characterized by ongoing rate cuts and a dovish Federal Reserve stance, suggests the possibility of further upward movement. While the $100 threshold remains distant, the likelihood of reaching such levels is increasing.

Despite the optimism among oil bulls, the breach of the $80 mark seems to be unfolding at a measured pace, with $85 emerging as the next potential resistance. Beyond that, levels of $86.90, $89.64, and the psychologically significant $90.00 are envisioned as top targets.

On the downside, the initial support is anticipated near the 200-day Simple Moving Average (SMA) at approximately $77.93. Close behind are the 100-day and 55-day SMAs, positioned near $75.81 and $75.26, respectively. Additionally, the pivotal level around $75.27 indicates a well-equipped defense against selling pressure, suggesting limited downside potential.