- WTI Oil pares back earlier gains on downbeat OPEC report.

- Oil traders are still positioned for more upside to come in the near term.

- The US Dollar Index trades just above 103.00 after US CPI release.

Oil prices are stabilizing after a turbulent ride spurred by the release of the monthly OPEC report. The primary factor driving crude prices into negative territory this Tuesday stems from Iraq, which has consistently exceeded its agreed production quota among OPEC nations for the second consecutive month.

Meanwhile, the US Dollar continues its upward trajectory, edging closer to surpassing the 104.00 mark. This second day of gains follows the release of US Consumer Price Index (CPI) figures, which met market expectations. Despite hopes for a more significant disinflationary outcome, the results indicate otherwise. Consequently, expectations for the timing of the initial rate cut by the US Federal Reserve have been recalibrated, with June or July now perceived as the most likely periods.

As of the current writing, Crude Oil (WTI) is trading at $78.01 per barrel, while Brent Oil is valued at $82.28 per barrel.

Oil news and market movers: dust settles on OPEC report

- Exxon was compelled to halt production at its Gravenchon facility in France, which has a capacity of 188,000 barrels per day, due to a fire incident on Monday, prompting a complete cessation of operations at the site.

- Iraq has surpassed its agreed output quota by producing over 200,000 barrels per day more than stipulated in the OPEC agreement.

- OPEC is set to unveil its monthly Oil Outlook report on Tuesday, although no specific time for its release has been disclosed.

- The US American Petroleum Institute (API) is scheduled to release its weekly Crude Oil stock data for the week ending March 8 at 20:30 GMT. The previous report indicated a modest build of 423,000 barrels.

- Russian Crude shipments are experiencing a resurgence, reaching their highest level in over a year, with a significant portion of the orders directed towards Asia.

Oil Technical Analysis: Iraq undercuts OPEC credibility

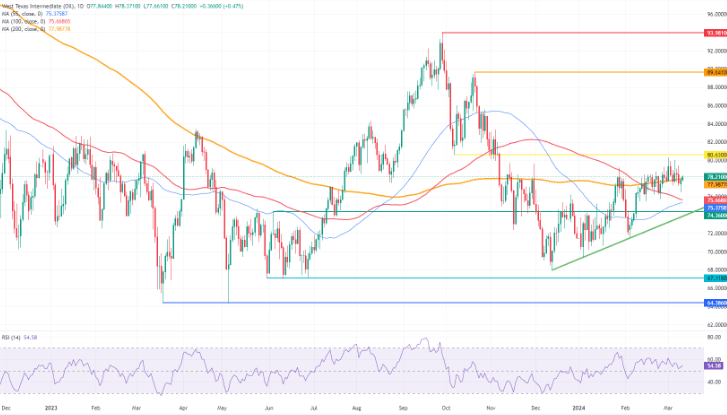

While oil prices may encounter some resistance from the OPEC report, there’s little groundbreaking information to digest. Crude has already surpassed the 200-day Simple Moving Average (SMA) at $77.98 and briefly breached the crucial $78 level. A positive surprise in the OPEC report regarding oil consumption or adherence to current supply cuts could propel crude towards $80 with relative ease.

Bullish sentiment remains strong among oil investors, as evidenced by the favorable spreads on oil futures. However, breaking above $80 seems to pose a challenge, with $86 emerging as the next significant resistance level. Beyond that, $86.90, $89.64, and $93.98 present themselves as key targets.

On the downside, the proximity of the 100-day and 55-day Simple Moving Averages (SMAs) around $75.71 and $75.31, respectively, coupled with the pivotal level near $75.27, suggests limited downside potential and a robust defense against selling pressure.