- WTI Oil trades up around 3% in just two trading days.

- Oil traders are seeing bullish positioning paying off after US stockpiles unexpectedly declined.

- The US Dollar Index trades at 103.00 after hot PPI data.

Oil prices are on a two-day rally following the release of the weekly US Crude data, which indicated a decrease in stockpiles. While the recent decline caught many by surprise, traders had already positioned themselves for such a drawdown in preceding days, raising concerns about the sustainability of US oil production levels. The dynamic between OPEC and the US appears to be akin to a game of chicken, with each side waiting to see who will yield first: the US facing substantial declines in stockpiles or OPEC being compelled to implement more extensive and prolonged production cuts.

In contrast, the US Dollar has seen significant gains after the release of upbeat US Producer Price data. The data surpassed expectations across the board, leaving traders uncertain about their next move. Federal Reserve Chairman Jerome Powell indicated that the Fed would consider rate cuts once data demonstrates a significant decline and confirms the containment of price pressures, even though the Fed has not signaled an imminent surge in inflation. This ambiguity could potentially delay expectations of an initial rate cut in June.

As of the latest update, Crude Oil (WTI) is trading at $80.13 per barrel, while Brent Oil is priced at $84.32 per barrel.

Oil news and market movers: IEA sees growth in demand

US crude stockpiles are in decline, as reported by the US Energy Information Administration, showing a reduction of over 1.5 million barrels in the week ending March 8, contrary to expectations of an increase. This aligns with data from the American Petroleum Institute (API) released on Tuesday, which indicated a decrease of 5.5 million barrels during the same period.

The International Energy Agency (IEA) suggests that there is potential for OPEC to ramp up production by the end of 2024 as a supply deficit begins to emerge. The IEA anticipates that July could mark the point at which OPEC+ fully reverses its production cuts.

Furthermore, the IEA has revised its oil demand forecasts, significantly increasing them by approximately 50% since their introduction last year in June.

Secret discussions have been held by the US with Houthi Rebels regarding attacks in the Red Sea.

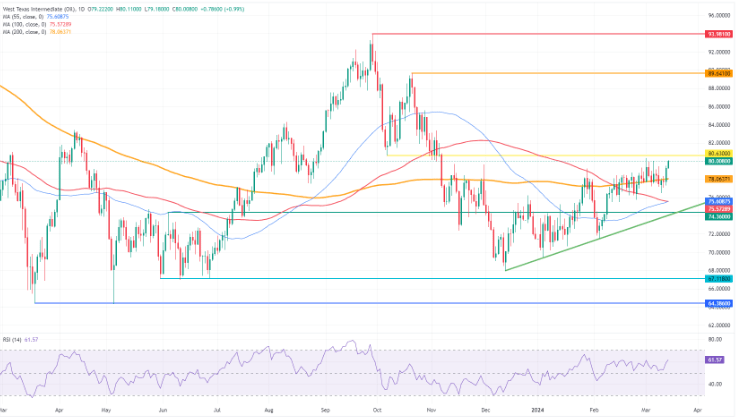

Oil Technical Analysis: OPEC steady and having a good hand

From a purely technical perspective, oil prices could be poised to embark on a broad uptrend. This is evident as the 55-day Simple Moving Average (SMA), currently at $75.61, intersects with the 100-day SMA, standing at $75.57. Once both indicators start to trend upward, it’s anticipated that oil prices will experience increased buying pressure. This could lead to a surge in bullish bets within the options market, resulting in a wider spread between puts and calls and subsequently generating volatility. Such volatility may propel crude oil to reach $89.64 by the summer months.

Oil bulls remain optimistic about further upside potential, particularly evident in the spreads on oil futures. A breakthrough above the $80 level necessitates a daily close to confirm a shift in sentiment. Subsequently, the next target is set at $86, followed by $86.90, with further upward targets at $89.64 and $93.98.

On the downside, the 100-day and 55-day Simple Moving Averages (SMA) hovering around $75.57 and $75.61, respectively, serve as key support levels. Coupled with the pivotal level near $75.27, these factors suggest that downside potential is limited, and there is substantial support to withstand selling pressure.