- Following lower-than-anticipated UK CPI data for February, the Pound Sterling experiences a decline.

- The soft UK inflation figures further solidify market expectations for the Bank of England (BoE) to initiate interest rate reductions starting in August.

- The upcoming monetary policy meeting of the Federal Reserve (Fed) will influence the direction of the US Dollar’s next move.

During Wednesday’s London session, the Pound Sterling (GBP) experienced a significant decline following the release of softer-than-expected Consumer Price Index (CPI) data for February by the United Kingdom Office for National Statistics (ONS). Both annual headline and core inflation figures decelerated to 3.4% and 4.5%, respectively. This lower inflation trajectory is anticipated to prompt Bank of England (BoE) policymakers to contemplate earlier interest rate cuts than previously anticipated by market participants.

As the BoE prepares to unveil its second monetary policy decision of 2024 on Thursday, investors should prepare for heightened volatility in the Pound Sterling. While the market expects the BoE to maintain interest rates at 5.25%, the subdued inflation data may provide policymakers with room to offer a slightly dovish stance on interest rates.

Furthermore, investor sentiment remains cautious ahead of the Federal Reserve’s (Fed) policy meeting announcement scheduled for 18:00 GMT. Attention will be squarely focused on the quarterly updated dot plot and economic projections. The Fed is widely expected to keep interest rates unchanged within the range of 5.25%-5.50%. The dot plot, reflecting interest rate projections by Fed officials across various time frames, will be closely scrutinized by investors for insights into the future path of monetary policy.

Daily digest market movers: Pound Sterling weakens on soft UK Inflation

- The Pound Sterling is facing downward pressure following the release of softer-than-anticipated consumer price inflation data for February by the United Kingdom’s Office for National Statistics (ONS). The annual headline inflation notably decelerated to 3.4%, falling short of expectations set at 3.6% and the previous reading of 4.0%. Additionally, the monthly headline Consumer Price Index (CPI) increased by 0.6%, rebounding from a similar decline observed in January. Investors had anticipated a higher growth rate of 0.7% in monthly headline inflation.

- Similarly, the annual core CPI, which excludes volatile food and energy prices, softened to 4.5%, below estimates of 4.6% and the previous reading of 5.1%. Bank of England (BoE) policymakers typically regard core inflation as a preferred metric for guiding interest rate decisions. The subdued figures may bolster their confidence that inflation will gradually return to the targeted rate of 2%. BoE officials have consistently emphasized that rate cuts would only be deemed appropriate if they are convinced that the inflation target is attainable.

- Expectations for the Pound Sterling to remain volatile are heightened as investors shift their attention to the Bank of England’s upcoming interest rate decision, scheduled for announcement on Thursday. The BoE is anticipated to maintain interest rates at the current level of 5.25%, marking the fifth consecutive meeting without changes. Investors will closely scrutinize indications regarding the timing of potential interest rate reductions. Presently, there is anticipation that the BoE may commence rate cuts starting from the August meeting, a sentiment reinforced by the soft inflation data unveiled on Wednesday.

- Meanwhile, market sentiment remains cautious ahead of the Federal Reserve’s monetary policy decision. The CME FedWatch tool indicates an expectation for the central bank to maintain interest rates within the range of 5.25%-5.50%. While the no-change scenario in interest rates is largely priced in, investors will closely monitor the monetary policy statement, Fed Chair Jerome Powell’s press conference, as well as the dot plot and economic projections for further insights.

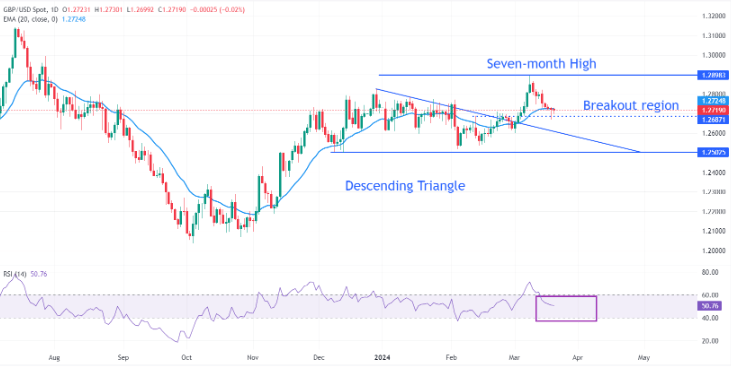

Technical Analysis: Pound Sterling drops below 1.2700

The Pound Sterling has marginally dipped below the breakout zone of the Descending Triangle, situated around 1.2700. Short-term demand for the GBP/USD pair appears uncertain, given its struggle to maintain levels above the 20-day Exponential Moving Average (EMA), currently hovering around 1.2730.

Facing downward pressure, the Pound Sterling finds support from the descending border of the Descending Triangle chart pattern. Conversely, a significant resistance level awaits at approximately 1.2900, representing a seven-month high for the Cable.

The 14-period Relative Strength Index (RSI) has reverted to the 40.00-60.00 range, indicating a notable contraction in volatility.