- The Bank of Canada (BoC) is anticipated to maintain its current interest rates.

- The Canadian Dollar is encountering strong resistance, particularly around the 1.3600 level.

- Inflation in Canada persists with resilience, albeit showing a downward trajectory.

There is a general expectation that the Bank of Canada (BoC) will maintain its policy rate at 5.0% for the fifth consecutive time during its upcoming policy meeting scheduled for Wednesday. The Canadian Dollar (CAD) has experienced notable depreciation against the US Dollar (USD) since the beginning of the year, following a significant rise from its November lows around 1.3900. Throughout this week, USD/CAD has exhibited a consolidative pattern in the upper range, aligning with the overall trend observed in the foreign exchange market.

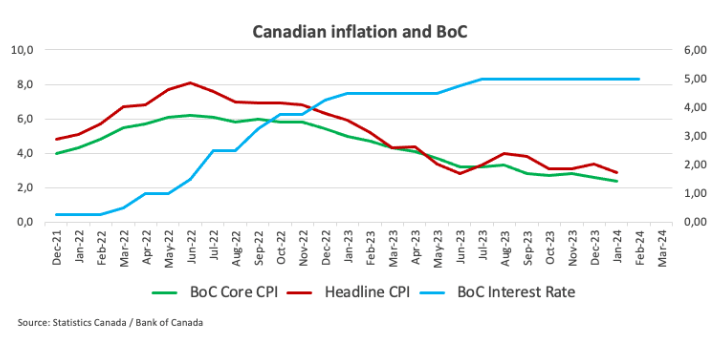

Headline inflation, as measured by the Consumer Price Index (CPI), continued its downward trajectory in the first month of the year, while the BOC’s Core CPI indicated persistent price pressures. Given this scenario, it is anticipated that the central bank will adopt a cautious stance, emphasizing the importance of evaluating additional incoming data and their sustainability before making any decisions regarding rate adjustments, particularly the initiation of an easing cycle. This perspective aligns with the views of most G10 central banks, including the Federal Reserve, European Central Bank, Bank of England, and Reserve Bank of Australia.

A hint of caution looms

Following its January meeting, the Bank of Canada (BoC) is anticipated to maintain a prudent outlook on GDP growth. During that meeting, the bank projected a growth rate of 0.8% for the current year and 2.4% in 2025, consistent with its earlier forecast released in October.

In terms of inflation, Governor Tiff Macklem stated in January that the upswing in shelter prices is the primary contributor to inflation surpassing the target. He emphasized that the path toward achieving 2% inflation is expected to be gradual, with lingering risks. Macklem argued that the policy interest rate of 5% is necessary to further mitigate inflationary pressures. Moreover, the focus of discussions regarding future policy is shifting from questioning the sufficiency of monetary policy restrictiveness to contemplating the duration of the current stance.

Recent reports suggest that fifteen out of twenty economists believe there is a higher probability of the first rate cut by the Bank of Canada occurring later than initially predicted rather than sooner. Furthermore, nineteen out of thirty-one economists expect the Bank of Canada to decrease the overnight rate from 5.00% to 4.75% in June.

TD Securities analysts stated, “We expect the BoC to stick to the recent script as it holds the overnight rate at 5.00% and continues to seek more evidence that inflation is on track for a sustained return to 2%. We anticipate the overall message to remain one of cautious optimism, and while the January CPI report skews risks towards a more dovish outcome, we do not expect the Bank will overreact to a single data point.”

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada is scheduled to announce its policy decision at 14:45 GMT on Wednesday, followed by Governor Macklem’s customary press conference at 15:30 GMT.

In the absence of surprises, any potential impact on the Canadian currency is anticipated to be minimal, if at all. A prudent decision to maintain existing conditions might lead to a brief, reflexive decline in USD/CAD, though its duration and magnitude are unlikely to be substantial. It’s important to note that much of the upward movement in the spot rate this year is attributed to USD dynamics.

Pablo Piovano, Senior Analyst at FXStreet.com, suggests, “the gradual uptrend in USD/CAD since the beginning of the year appears strengthened by the recent surpassing of the key 200-day SMA at 1.3479. However, this trend has encountered a decent barrier around the 1.3600 neighborhood. A sustained break above this region could propel the pair toward the November 2023 peak of 1.3898 (November 1).”

Piovano adds, “If sellers regain control, the 55-day SMA at 1.3428 should provide temporary support before the weekly low of 1.3358 (January 31). Further weakness from here could open the door to a move to the December 2023 bottom of 1.3177 (December 27).”

Canadian Dollar price today

The following table illustrates the percentage change of the Canadian Dollar (CAD) against various major currencies today. The Canadian Dollar exhibited its strength particularly against the New Zealand Dollar.