- Silver notches a 0.60% increase, trading at $24.46, buoyed by a cautious market sentiment.

- Technical analysis hints at potential for breaking the $24.50 barrier, targeting year-highs.

- Downside risks loom if silver dips below $24.18, with critical supports at $24.00 and $23.57 in focus.

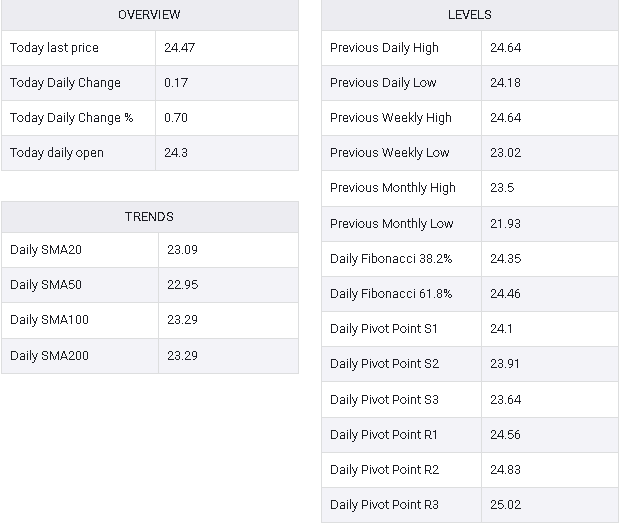

Silver moderately advances as the New York session concludes, posting a gain of 0.60%, with XAG/USD trading at $24.46 after reaching a low around $24.24. The rise in the price of the grey metal is attributed to a risk-off sentiment amid elevated US Treasury bond yields. However, it remains below the peak of $24.50 reached last week.

XAG/USD Price Analysis: Technical outlook

Silver rebounded from the low in the $24.20s range, surging towards the $24.40 region but falling short of breaching the psychological barrier at $24.50. Although the Relative Strength Index (RSI) indicators suggest further upside potential, buyers need to surpass that level. Once achieved, the next targets include the current year-to-date (YTD) high of $24.63, followed by the peak on August 30 at $25.00. A decisive breakthrough would expose the high on December 4 at $25.91.

In an alternative scenario, if sellers take control and push XAG/USD below the March 8 low of $24.18, downside risks become apparent around $24.00. The subsequent support would be at the March 6 low of $23.57.

XAG/USD Price Action – Daily Chart

XAG/USD