- Silver’s bullish streak leads above $25.00, defying broader market trends with over 1.40% gains.

- A new year-to-date high at $25.44 highlights XAG/USD’s resilience, with $26.00 now in sight as next resistance.

- Should Silver retreat below $25.00, a move towards $24.50 and potentially $24.01 could unfold, testing buyer strength.

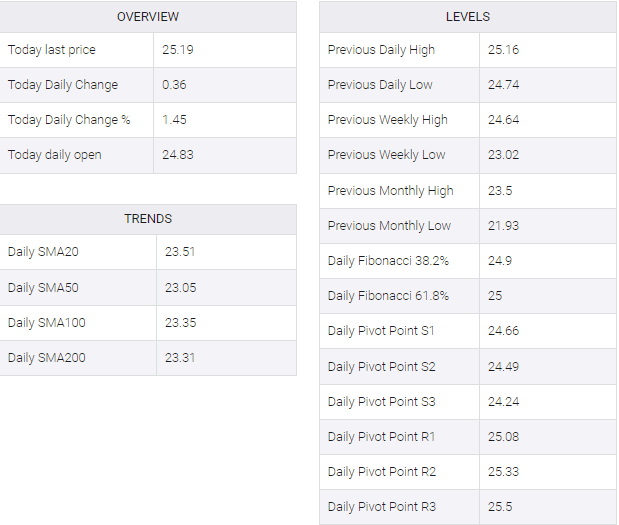

On Friday, silver’s price gleams brightly, surging by over 1.40% despite gold experiencing two consecutive days of decline. Currently, it stands at $25.18 per troy ounce, marking a 1.52% rise. The XAG/USD pair progresses even in the face of a robust Greenback, supported by elevated US Treasury bond yields.

XAG/USD Price Analysis: Technical outlook

During the session, Silver surged to a new year-to-date (YTD) high of $25.44, but its ascent toward $26.00 was hindered by an upslope support trendline, which acted as resistance. As a result, XAG/USD retreated towards its current price levels. However, the Relative Strength Index (RSI) indicator remains bullish, signaling that bullish momentum persists, and the $26.00 resistance level may still be within reach.

Conversely, if XAG/USD drops below $25.00, sellers may target the $24.50 region, followed by the March 12 daily low of $24.01.

XAG/USD Price Action – Daily Chart

XAG/USD