- Silver price undergoes a correction after approaching the upper boundary of a significant range, hovering around $26.00.

- The retreat may be attributed to diminishing expectations of near-term interest rate cuts by the Federal Reserve.

- Nevertheless, long-term fundamentals remain favorable, supported by positive global economic growth and resilient demand.

Silver price (XAG/USD) retreats at the beginning of the week, trading in the vicinity of the $25.10s, having approached the upper limit of a prolonged range.

The correction could stem from shifting expectations regarding the future trajectory of interest rates, with forecasts now indicating they will likely remain elevated for an extended period in the US.

Similar to gold, silver is a non-yielding asset, carrying an opportunity cost for holders who forgo interest-bearing investments. Persistent high inflation in the US, as reflected in recent data, has postponed expectations for the Federal Reserve (Fed) to implement interest rate cuts. This delay may be exerting downward pressure on the silver price.

Silver: Long-term bullish fundamentals

While interest rates are a significant factor influencing the price of Silver, other dynamics also play a crucial role. The metal’s application in various industrial processes positions it as a key player in the broader context of global growth prospects, which can positively impact long-term demand for Silver.

Chinese economic data unveiled on Monday demonstrated a notable uptick in Industrial Production, exceeding expectations with a 7.0% rise in February, surpassing both estimates and previous figures. Fixed Asset Investment, indicating expenditure in infrastructure and equipment, also recorded an increase of 4.2% in February, outperforming forecasts. Retail Sales, although higher than anticipated, moderated compared to previous levels, according to the National Bureau of Statistics of China.

Similarly, recent data from the US Federal Reserve highlighted a better-than-expected performance in Industrial Production for February, showing an improvement from the negative 0.5% recorded in January.

Marcus Garvey, an analyst at Macquarie, suggests that Silver price could witness further gains as global demand surges, driven by its indispensable role in the production of solar panels, a diverse array of electronic devices, and jewelry.

The Silver Institute, a non-profit organization based in the US, has forecast robust demand for Silver in 2024, projecting it to reach its second-best year on record with demand anticipated to surge to 1.2 billion ounces.

Technical Analysis: Silver knocks on the top of range

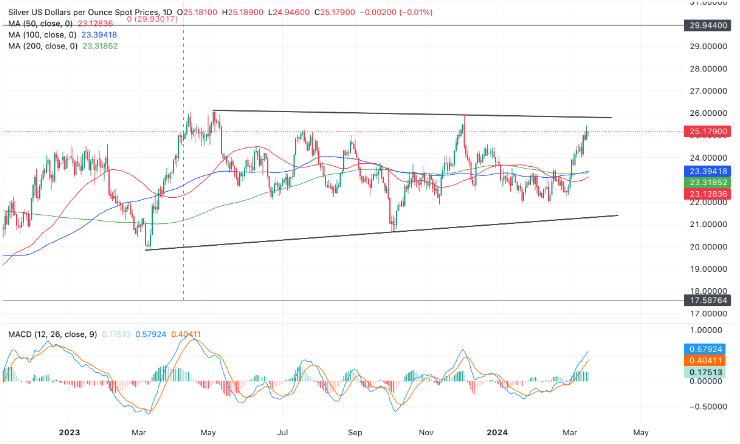

From a technical standpoint, XAG/USD experiences a retracement after nearing the upper boundary of a range spanning from $19.00 to $26.00. This range is situated within a broader range spanning from $17.50 to $30.00.

A decisive breach above $25.85 would likely signal a breakout to the upside, fueling bullish sentiment significantly.

Should this occur, silver could potentially rally towards approximately $29.50, based on the 0.618 Fibonacci ratio of the range, or approach just below $32.00 if extrapolating the full height of the range upward.

If the latter scenario materializes, it would signify a breakout above the upper boundary of the broader range, suggesting even greater upside potential, potentially targeting $37.50.

Alternatively, the precious metal may encounter significant resistance at the range highs around the $25.80-90s and undergo a pullback.

Traders are advised to monitor for a definitive breakout before initiating positions. A “decisive” breakout is defined by a prolonged green daily candle clearly piercing above the level and concluding near its peak, or the occurrence of three consecutive green candles surpassing the level.