- The Swiss Franc edges lower versus the USD after strating strong on risk aversion.

- The Swiss Franc is the go-to safe haven when investors become fearful.

- USD/CHF has turned lower after touching a key resistance level on the weekly charts.

On Monday, the Swiss Franc (CHF) is experiencing a slight decline against the US Dollar (USD) following an initially robust performance, leveraging its safe-haven appeal. Global equity markets, serving as a pivotal gauge for risk sentiment, are witnessing a downturn amid uncertainties surrounding the economic outlook. Concerns arise from news about another property bailout in China and worries about over-valuation. European equities are predominantly in the red, with most experiencing a decrease of over half a percentage point, while US indices are also showing negative trends as Wall Street commences its trading day.

Swiss Franc vulnerable, HSBC says

Analysts at HSBC anticipate a near-term depreciation of the Swiss Franc, attributing this outlook to the Swiss National Bank’s (SNB) reluctance to adopt policies aimed at strengthening the currency. The analysts also point to the prevailing environment of upward-trending equity markets as a significant factor influencing the potential decline.

In a February interview with Bloomberg, SNB Chairman Thomas Jordan expressed concerns about the Swiss Franc’s strength, noting that it might be excessively robust. While acknowledging the currency’s beneficial role in shielding the country from inflationary pressures, Jordan highlighted that the Franc had started to rise in real terms by the end of 2023, posing potential challenges for Swiss businesses.

The recent dip in core inflation data for Switzerland, falling to 1.1% in February from the previous 1.2%, further supports the notion that the SNB is unlikely to raise interest rates in the near future.

On the Horizon

The upcoming focal point for USD/CHF is the release of the US Consumer Price Index (CPI) data for February, scheduled for Tuesday at 12:30 GMT.

Projections suggest that the Consumer Price Index, excluding Food and Energy, is expected to ease to 3.7% YoY from the previous 3.9%, with a monthly change of 0.3% compared to the prior 0.4%. The headline CPI figure is forecasted to remain steady at 3.1% YoY, unchanged from the previous month, and exhibit a 0.4% MoM increase, up from 0.3% in the preceding month.

The outcome of the CPI data holds significance in determining the timing of potential interest rate cuts by the Federal Reserve (Fed). A lower-than-anticipated result might prompt the Fed to consider earlier rate cuts, potentially negatively impacting the USD as it diminishes foreign capital inflows.

As per the CME FedWatch Tool, which gauges market-based expectations for the initiation of Fed Funds Rate reductions, there is a 4% probability of a first cut in March, a 31.5% likelihood in May, and a substantial 73.8% chance of a cut by June.

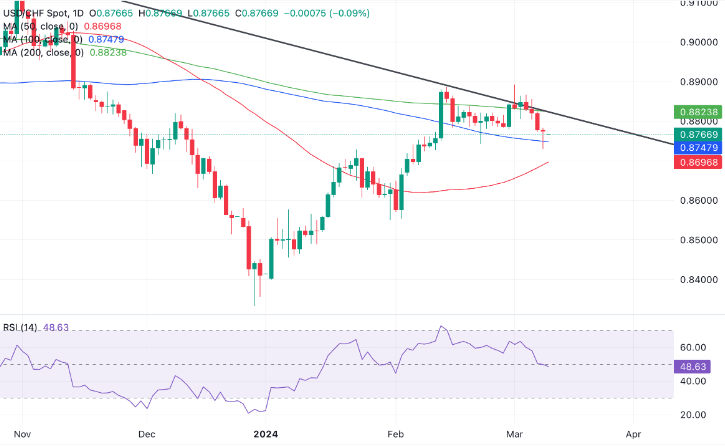

Technical Analysis: Swiss Franc vs US Dollar turns lower after touching key resistance level

The USD/CHF, representing the quantity of Swiss Francs obtainable with one US Dollar, is approaching significant technical thresholds on the charts, signaling the potential commencement of a reversal aligned with the enduring downtrend.

Upon inspection of the weekly chart, the current price is in proximity to the descending trendline of a channel, along with the pivotal 50-week Simple Moving Average (SMA). This juncture raises the possibility of an inflection point, suggesting a reversal wherein the pair may resume its descent within the established falling channel.

Examining the daily chart provides a closer look at the ongoing struggle around the previously highlighted resistance levels. The currency pair has retraced from the channel line and the weekly Moving Average (MA). Additionally, it has dipped below the intraday low of 0.8742 on February 22, suggesting the potential for a more substantial decline toward the 0.8645 level. A decisive break below 0.8645 would confirm a short-term trend reversal, establishing a bearish bias. In such a scenario, the subsequent target would be the support level at the January 31 lows of 0.8551.

The current scenario suggests a notable likelihood of a reversal in the price’s upward trend. Nevertheless, a notable probability remains for a potential recovery and a resumption of the upward trajectory. Confirmation of a continued short-term uptrend would be signaled by a breach above the high of 0.8892, potentially paving the way for an extended move towards a target around 0.9056.