- The Swiss Franc is forecast to fall as the Swiss National Bank (SNB) drops its strong FX policy.

- The central bank had previously strengthened the Franc as a means of subduing inflation.

- The SNB is jettisoning the approach as it considers the CHF is “too strong” for Swiss exporters.

On Wednesday, the Swiss Franc (CHF) maintains a trading range in the upper 0.8700s against the US Dollar (USD). The general outlook for the Swiss Franc isn’t particularly optimistic due to the policy stance of its central bank, the Swiss National Bank (SNB), which aims to deter a strong Franc.

During the European session, there is a resurgence in risk appetite, with the DAX, CAC 40, and FTSE 100 all showing gains for the day. However, this positive risk sentiment isn’t conducive to the Swiss Franc’s strength, given its status as a safe-haven currency.

Swiss Franc at risk from SNB policy approach

The upside potential of the Swiss Franc is likely to be limited as the Swiss National Bank (SNB) shifts its policy stance towards the currency. Previously, the SNB had strengthened the CHF to curb inflation. However, SNB Chairman Thomas Jordan recently stated that the Franc has become excessively strong for Swiss businesses, particularly exporters.

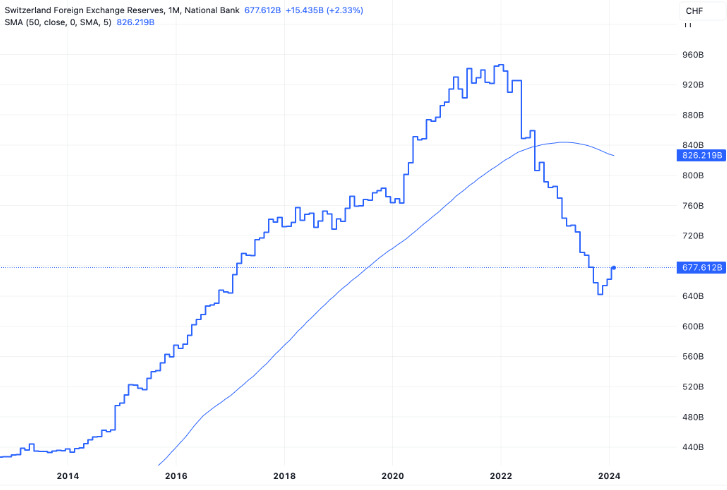

These remarks are consistent with the data on Switzerland’s Foreign Exchange Reserves (CHFER), which indicates a gradual recovery in non-CHF FX reserves since the autumn of 2023. This suggests that the SNB may be intervening in the foreign exchange market by selling the Swiss Franc and purchasing other currencies, with the objective of mitigating the appreciation of the CHF.

According to analysts at HSBC, the Swiss Franc is expected to experience a decline against the US Dollar in the near future. This projection stems from the observation that foreign exchange strength is no longer regarded as a strategic tool or policy objective for the Swiss National Bank (SNB). Furthermore, the ongoing robust performance of global equity markets further supports this outlook.

On the Horizon

The upcoming release of Swiss Producer and Import Prices for February represents a notable event for the Swiss Franc, although historically, its impact on the exchange rate has been limited. However, an unexpected increase in this metric, scheduled for 7:30 GMT on Thursday, would likely bolster the Swiss Franc, whereas a decrease would have the opposite effect. In January, previous results indicated a year-on-year decline of 2.3% and a month-on-month decrease of 0.5%.

Meanwhile, the release of US Producer Prices Excluding Food & Energy for February, also on Thursday at 12:30 GMT, holds significance for the US Dollar and USD/CHF. Current forecasts anticipate a slowdown to a year-on-year growth rate of 1.9% from the 2.0% increase observed in January. Additionally, the release of US Retail Sales data at the same time could stir volatility in US pairs.

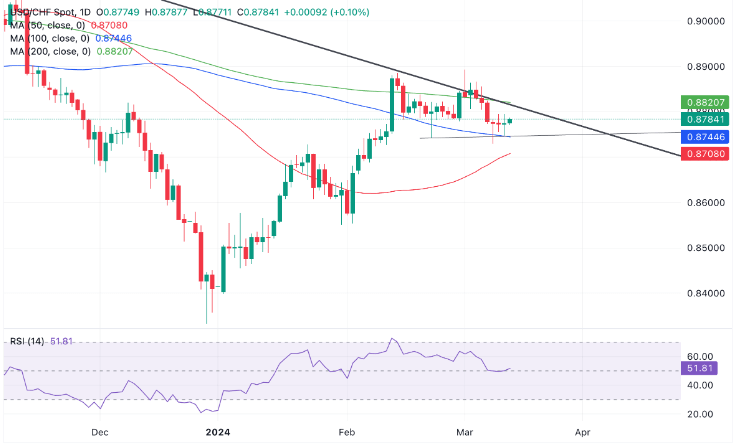

Technical Analysis: Swiss Franc versus US Dollar pinned below trendline

The USD/CHF, representing the amount of Swiss Francs obtainable for one US Dollar, remains constrained below several significant technical thresholds.

Primarily, it contends with the descending trendline of a downward channel, positioned approximately at 0.8780. Additionally, the pivotal 50-week Simple Moving Average (SMA) stands at 0.8850, though not depicted in the chart. These levels serve as touchpoints of resistance, prompting speculation that they could signify a turning point for a potential reversal, initiating a downward trajectory once more.

USD/CHF has breached the crucial low of February 22 at 0.8742, yet it failed to close below it. Nonetheless, this breach signals weakness and raises the prospect of a more substantial downturn towards the level of 0.8645.

Should the price break below this level, it would likely signify a reversal of the short-term trend. Subsequently, the next target to the downside would be 0.8645, followed by the lows of January 31 at 0.8551.

However, there remains a notable chance for USD/CHF to rebound and resume its upward trajectory. A breakthrough above the trendline and the high of 0.8892 would indicate a continuation of the short-term uptrend, potentially targeting a level around 0.9056.