- Traders are keeping a close eye on EUR/USD as it remains range-bound, awaiting the next significant market catalyst: the release of US CPI data scheduled for Wednesday.

- Expectations for US inflation are elevated, coinciding with a new high for the year in US Treasury yields.

- The currency pair is currently trading within a tight range, confined by the 50, 100, and 200-day Simple Moving Averages.

EUR/USD remains trapped, fluctuating within marginal gains and losses in the 1.0860s on Tuesday. The subdued volatility suggests many traders are abstaining from active participation, possibly in anticipation of the week’s primary market catalyst: the release of US Consumer Price Index (CPI) inflation data for March, slated for Wednesday.

EUR/USD traders withdraw to patiently await inflation data

Until the release of CPI data, EUR/USD is expected to remain relatively stable. Economists anticipate the data will reveal a 3.4% Year-on-Year increase in US prices for March (with core goods rising by 3.7% YoY), both figures surpassing the Federal Reserve’s 2.0% target. However, a more significant decrease is necessary before the Fed considers reducing interest rates from their current level of 5.5%.

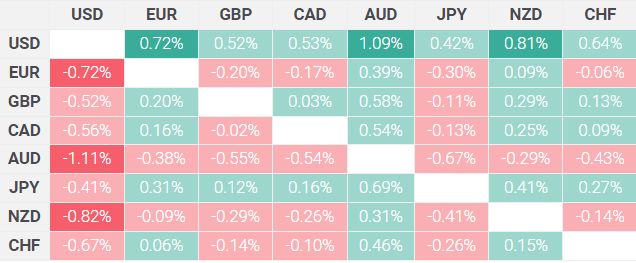

The higher interest rates in the US compared to the Eurozone pose a bearish challenge for EUR/USD. This discrepancy favors foreign capital inflows due to the relatively higher rates.

In contrast, the European Central Bank (ECB) is perceived as more inclined to initiate interest rate cuts sooner, given the Eurozone’s subdued growth and inflation outlook.

US Treasury Yields reach Year-to-Date Peak

US Treasury yields, a significant indicator of US inflation expectations, reached yearly highs on Monday, with the 10-year Treasury Note yield hitting 4.46%. These yields are closely tied to the US Dollar and inversely related to the EUR/USD pair. Following their peak on Monday, they have since declined slightly.

US inflation expectations rose following the impressive Nonfarm Payrolls (NFP) report released on Friday, which indicated an additional 303,000 workers joined the economy in March. Typically, an increase in employment signifies more earning and spending, which might have a negative impact on EUR/USD. Surprisingly, however, the pair has been on an upward trend over the past five days.

The release of better-than-expected German Industrial Production data on Monday likely provided a boost to the Euro at the beginning of the week.

According to Gregor Horvat of advisory firm Wavetraders, German yields are rising at a faster pace than US yields. This discrepancy may elucidate why EUR/USD continues to climb despite robust US data.

Horvat, who employs Elliott Wave analysis, a type of cycle theory, anticipates EUR/USD to extend its rally up to 1.0920 before the ECB meeting on Thursday.

Technical Analysis: EUR/USD increasingly looking range-bound

In the short term, EUR/USD appears to be consolidating within a narrow range.

After the bearish Gravestone Doji candlestick was observed on Thursday, the pair did not validate this pattern as prices rebounded the next day, forming a bullish Dragonfly Doji candlestick. These opposing candlesticks essentially nullified each other (as indicated by the shaded rectangle on the chart).

EUR/USD is currently ensnared between three notable Moving Averages. The 50-day and 200-day SMAs are offering sturdy support around 1.0830 and 1.0831, respectively, while the 100-day SMA poses resistance at 1.0873.

A definitive breach above the 100-day SMA would bolster the bullish scenario, potentially leading to a rally towards the March 21 high at 1.0942.

Conversely, a decisive drop below the cluster of Moving Averages in the 1.0830s may trigger a pullback towards support around the April 2 swing lows of 1.0725.