- USD/CAD demonstrates resilience above the 1.3500 level as a dynamic week unfolds.

- Market consensus suggests the Federal Reserve will maintain interest rates within the 5.25%-5.50% range.

- The Canadian Dollar encounters tension in anticipation of forthcoming consumer inflation data for February.

In the European session on Monday, the USD/CAD pair maintains its position comfortably above the psychological resistance of 1.3500. The Canadian Dollar remains steady as uncertainty looms ahead of the Federal Reserve’s interest rate decision scheduled for Wednesday.

While it’s widely expected that the Fed will maintain interest rates within the 5.25%-5.50% range, market attention is particularly drawn to the release of the dot plot, offering insights into policymakers’ future interest rate projections and economic outlook.

The US Dollar Index (DXY) shows a slight decline to 103.40, while the Canadian Dollar exhibits strength, indicating some weakness in the Loonie.

Anticipation builds around the February inflation data for Canada, set to be released on Tuesday. Forecasts suggest a potential acceleration in the annual headline Consumer Price Index (CPI) to 3.1% from January’s 2.9%. Any inflation figures surpassing expectations may delay the Bank of Canada’s (BoC) plans for interest rate reductions.

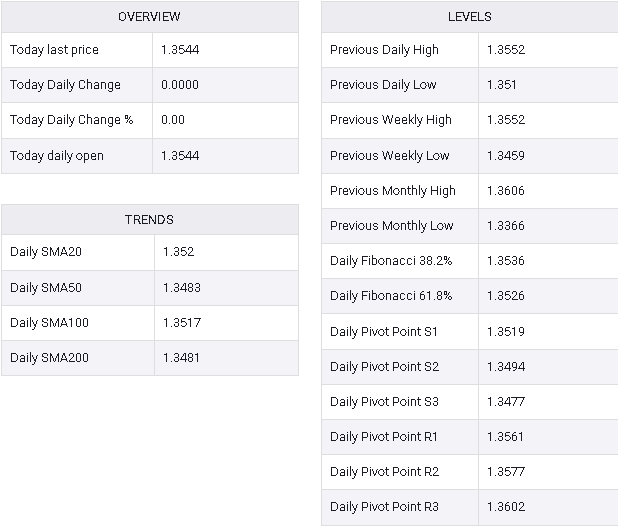

Currently, USD/CAD trades within Friday’s range around 1.3540. Earlier, the Canadian Dollar rebounded from the upward-sloping border of an Ascending Triangle pattern traced on a daily timeframe since the December 27 low at 1.3177. Notably, the pattern’s horizontal resistance, derived from the December 7 high at 1.3620, remains significant.

Supporting the US Dollar bulls, the 50-day Exponential Moving Average (EMA) near 1.3500 remains intact.

The 14-period Relative Strength Index (RSI) fluctuates within the 40.00-60.00 range, signaling investor indecision.

A break above the December 7 high at 1.3620 could propel the pair towards the May 26 high at 1.3655, with potential resistance at the 1.3700 level. Conversely, a downside move below the February 22 low at 1.3441 could expose the asset to the February 9 low at 1.3413, and further down to the January 15 low at 1.3382.

USD/CAD daily chart

USD/CAD