- USD/CAD jumps above 1.3600 as Canadian consumer inflation surprisingly eases in February.

- BoC’s preferred inflation measure decelerated to 2.1% from 2.4% in January on a year-on-year basis.

- The market sentiment remains downbeat amid uncertainty ahead of Fed policy.

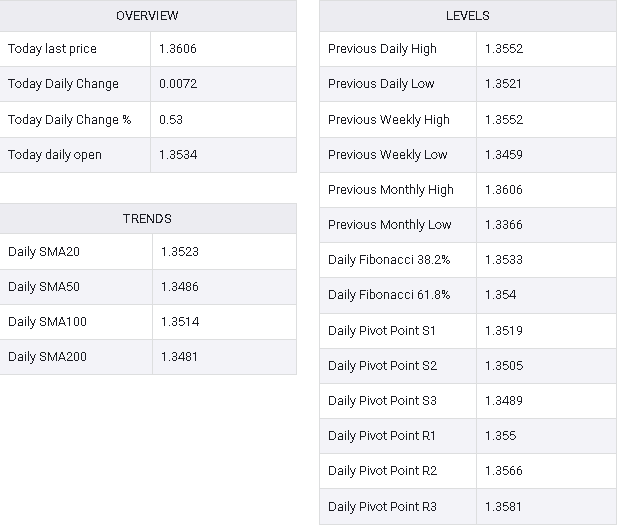

In the early New York session on Tuesday, the USD/CAD pair surged above the significant resistance level of 1.3600 as the Canadian Dollar strengthened following softer-than-expected Canadian Consumer Price Index (CPI) data for February.

The annual headline CPI grew at a slower pace of 2.8%, below expectations of 3.1% and the previous reading of 2.9%. On a monthly basis, the headline CPI increased by 0.3%, falling short of the expected 0.6%. The Bank of Canada’s preferred inflation measure, which excludes eight volatile items, saw steady monthly growth of 0.1%. However, underlying inflation decelerated to 2.1% from January’s 2.4%.

The disappointing inflation figures raise expectations that the Bank of Canada may consider reducing interest rates sooner than anticipated, which could lead to liquidity outflows and further pressure on the Canadian dollar.

Furthermore, the Canadian Dollar has been weighed down by gloomy market sentiment amid uncertainty ahead of the Federal Reserve’s interest rate decision scheduled for Wednesday. The Fed is expected to maintain interest rates within the range of 5.25%-5.50%. Increased demand for safe-haven assets has propelled the US Dollar Index (DXY) to 103.85.

In addition to the Fed’s policy decision, investors will closely monitor the dot plot and economic projections, which illustrate policymakers’ interest rate forecasts across various timeframes.

USD/CAD