- USD/CAD gains grounds on higher US Treasury yields.

- Fed’s Bostic anticipates that the first Fed rate cut around the end of this year.

- The higher WTI price could provide support for the Canadian Dollar.

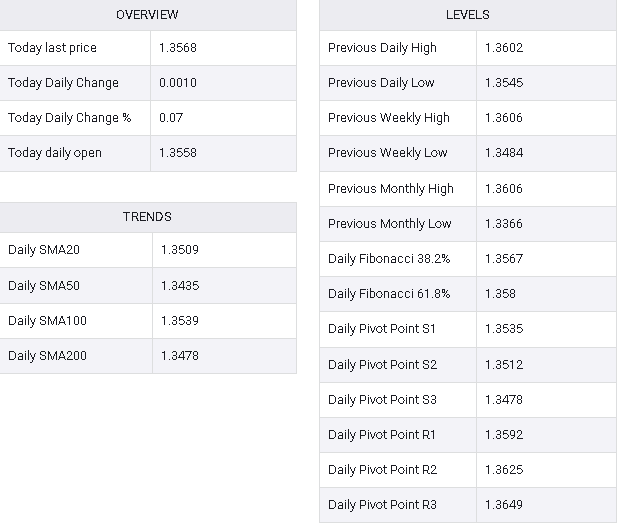

During Monday’s European session, USD/CAD climbed higher, nearing 1.3570, benefiting from a stable US Dollar (USD) and improved US Treasury yields. Atlanta Fed President Raphael W. Bostic’s expressed anticipation of a potential interest rate cut by the end of this year at the earliest provided some support for the USD.

The CME FedWatch Tool indicates a 5.0% probability of rate cuts in March, with estimates for cuts in May and June at 26.8% and 53.8%, respectively.

However, the USD faced downward pressure following lackluster February manufacturing figures from the US, with the ISM Manufacturing PMI dropping to 47.8 from 49.1, missing the market expectation of 49.5. The Manufacturing New Orders Index also decreased to 49.2 from the previous 52.5.

Despite this, the Canadian Dollar (CAD) found support from higher crude oil prices, limiting the upside for the USD/CAD pair. West Texas Intermediate (WTI) oil price edged higher to around $79.70 per barrel.

The surge in crude oil prices followed OPEC+ decisions to extend voluntary oil output cuts and heightened tensions in the Middle East. Traders are now awaiting the Bank of Canada’s (BoC) policy meeting on Wednesday, with market expectations leaning towards the central bank maintaining its current 5.0% interest rate.

USD/CAD